NEW YORK, Feb. 25, 2019 (GLOBE NEWSWIRE) — Piedmont Lithium Limited (Nasdaq:PLL; ASX:PLL) is pleased to announce that it will be participating in the following upcoming conferences:

| Event: | BMO 2019 Global Metals & Mining Conference | ||||

| Date: | February 24-27, 2019 | ||||

| Location: | Hollywood, Florida | ||||

| Event: | Battery Japan | ||||

| Date: | February 27 – March 1, 2019 | ||||

| Location: | Tokyo, Japan | ||||

| Event: | Metals Investor Forum | ||||

| Date: | March 1-2, 2019 | ||||

| Location: | Toronto, Ontario | ||||

| Event: | Prospectors & Developers Association of Canada | ||||

| Date: | March 3-6, 2019 | ||||

| Location: | Toronto, Ontario | ||||

| Event: | g.research Specialty Chemicals Conference | ||||

| Date: | March 13, 2019 | ||||

| Location: | New York, New York | ||||

| Event: | Roth Investor Conference | ||||

| Date: | March 18-20, 2019 | ||||

| Location: | Laguna Niguel, California |

Investors interested in meeting with Piedmont at or around these events should contact:

| Keith D. Phillips | Anastasios (Taso) Arima | ||

| President & CEO | Executive Director | ||

| T: +1 973 809 0505 | T: +1 347 899 1522 | ||

| E: kphillips@piedmontlithium.com | E: tarima@piedmontlithium.com |

About Piedmont Lithium

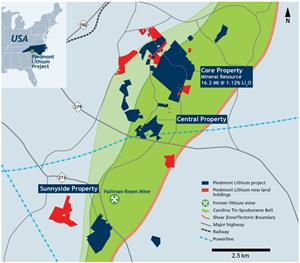

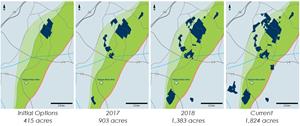

Piedmont Lithium Limited (ASX: PLL; Nasdaq: PLL) holds a 100% interest in the Piedmont Lithium Project located within the Carolina Tin-Spodumene Belt (“TSB”) and along trend to the Hallman Beam and Kings Mountain mines, which historically provided most of the western world’s lithium between the 1950s and the 1980s. The TSB has been described as one of the largest lithium regions in the world and is located approximately 25 miles west of Charlotte, North Carolina.

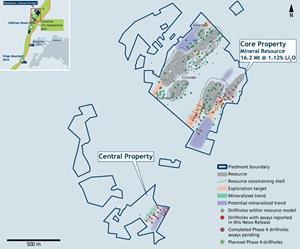

In September 2018 the Company published a Scoping Study for an integrated lithium hydroxide business based on a maiden Mineral Resource estimate of 16.2 million tonnes (“Mt”) grading at 1.12% Li2O which featured a 13-year project life, NPV8 of US$888 million, a US$3,112 per tonne lithium hydroxide operating cost, and a US$193 per tonne spodumene concentrate operating cost.

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on Piedmont’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Piedmont, which could cause actual results to differ materially from such statements. Piedmont makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information contained in this announcement has been prepared in accordance with the requirements of the securities laws in effect in Australia, which differ from the requirements of U.S. securities laws. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Australian terms defined in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). However, these terms are not defined in Industry Guide 7 (“SEC Industry Guide 7”) under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and are normally not permitted to be used in reports and filings with the U.S. Securities and Exchange Commission (“SEC”). Accordingly, information contained herein that describes Piedmont’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. U.S. investors are urged to consider closely the disclosure in Piedmont’s Form 20-F, a copy of which may be obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.

Competent Persons Statement

The information in this announcement that relates to Exploration Results is based on, and fairly represents, information compiled or reviewed by Mr. Lamont Leatherman, a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy and Exploration’, a ‘Recognized Professional Organization’ (RPO). Mr. Leatherman is a consultant to the Company. Mr. Leatherman has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Leatherman consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The Project’s Mineral Resource of 16.2Mt @ 1.12% Li2O comprises Indicated Mineral Resources of 8.5Mt @ 1.15% Li2O and Inferred Mineral Resources of 7.7Mt @ 1.09% Li2O. The information in this announcement that relates to Exploration Targets and Mineral Resources is extracted from the Company’s ASX announcement dated June 14, 2018 which is available to view on the Company’s website at www.piedmontlithium.com. The information in this announcement that relates to Metallurgical Testwork Results is extracted from the Company’s ASX announcements dated September 4, 2018 and July 17, 2018 which are available to view on the Company’s website at www.piedmontlithium.com. The information in this announcement that relates to Process Design, Process Plant Capital Costs, and Process Plant Operating Costs is extracted from the Company’s ASX announcements dated September 13, 2018 and July 19, 2018 which are available to view on the Company’s website at www.piedmontlithium.com. The information in this announcement that relates to Mining Engineering and Mine Schedule is extracted from the Company’s ASX announcements dated September 13, 2018 and July 19, 2018 which are available to view on the Company’s website at www.piedmontlithium.com.

Piedmont confirms that: a) it is not aware of any new information or data that materially affects the information included in the original ASX announcements; b) all material assumptions and technical parameters underpinning Mineral Resources, Exploration Targets, Production Targets, and related forecast financial information derived from Production Targets included in the original ASX announcements continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially modified from the original ASX announcements.