Study demonstrates robust project economics, positive impacts of the Inflation Reduction Act

- Feasibility indicates results of NPV8 of $2.5 billion and post-tax IRR of 32% for the 30-year project

- Average annual steady state EBITDA and after-tax cash flow increase to $376 and $317 million, respectively

- Project economics demonstrate positive impact of America’s pro-EV policies

- Innovative Metso:Outotec technology to provide improved sustainability profile over conventional conversion

- Development-ready site with infrastructure, workforce, customer proximity, and cooperative government

- Zoned for industrial use, reducing number of permits and approvals required to commence construction

- Availability of low-cost, clean, reliable energy with TVA’s net-zero by 2050 aspiration

- Permitting and project financing activities advancing with goal of commencing construction in 2024

BELMONT, NC, April 20, 2023 – Piedmont Lithium Inc. (“Piedmont” or the “Company”) (Nasdaq:PLL; ASX:PLL), a leading global developer of lithium resources, is pleased to report the results of a Definitive Feasibility Study (“DFS” or “Study”) of the Company’s proposed Tennessee Lithium project in McMinn County, Tennessee. The Study of the 30,000 metric ton per year (“tpy”) lithium hydroxide (“LiOH”) plant featuring the innovative and waste-reducing Metso:Outotec conversion technology affirms the potential for Piedmont to develop an American-based lithium hydroxide business using spodumene concentrate from market sources, including via existing offtake agreements with Sayona Quebec and Atlantic Lithium.

Study economics for Tennessee Lithium are shown in Table 1 below and are highlighted by an estimated after-tax NPV (8% discount rate) of $2.5 billion and an after-tax IRR of 32%. The Study assumes fixed prices of $26,000 per metric ton of lithium hydroxide and $1,600 per metric ton of spodumene concentrate over the project’s 30-year life. The model includes a Section 45X production tax credit of 10% under the Inflation Reduction Act of 2022 and assumes a credit of $141.7 million against project capital costs based on expected receipt of a U.S. Department of Energy (“DOE”) grant. Tennessee Lithium development remains subject to, among other things, receipt of material permits and arrangement of project financing.

| Table 1: Project Summary Outcomes | Unit | Tennessee Lithium DFS (March 2023) |

|---|---|---|

| Operation life | years | 30 |

| Steady state annual LiOH production | tpy | 30,000 |

| Total initial capital cost | $mm | $809 |

| After-tax Net Present Value @ 8% discount rate |

$mm |

$2,492 |

| After-tax Internal Rate of Return | % | 32% |

| Steady state LiOH conversion all-in sustaining costs | $/t | $2,952 |

| Steady state spodumene purchase costs | $/t LiOH | $10,721 |

| Average annual steady state EBITDA | $mm/y | $376 |

| Average annual steady state after-tax cash flow | $mm/y | $317 |

| Payback from start of operations | years | 2.8 |

Piedmont President and Chief Executive Officer Keith Phillips, said he was pleased with the project economics and the positive impact of the Inflation Reduction Act, which strongly favors domestic battery and critical minerals production. “America’s pro-EV and battery manufacturing policies are providing an advantage to Piedmont at a time when many analysts are projecting lithium shortages to continue into the 2030s. Piedmont’s selection for a $141.7 million grant last year by the U.S. Department of Energy exemplifies America’s commitment to developing a domestic lithium supply chain.[1]”

“Tennessee Lithium is positioned to be a key resource for EV and battery manufacturers,” Phillips added. “Through long-term supply agreements with our partners, we can source raw material from spodumene that we own or in which we have an economic interest, providing greater control of our feedstock while capturing the economics of integrated production. We can advance development of the operation with revenues anticipated from the restart of North American Lithium and our recent offtake agreements with Tesla and LG Chem. Further, with the Metso:Outotec flowsheet, we believe we can sustainably produce critical lithium materials on a cost-effective basis for a more responsible profile compared to producers utilizing sulfuric acid roasting.”

Piedmont is advancing permitting and project financing activities for Tennessee Lithium with the goal of beginning construction in 2024. The Company is focused on first commercial shipments in Q3 from North American Lithium with revenue generation to support activities across Piedmont’s global portfolio of projects, including Tennessee Lithium. A DFS is expected mid-2023 for the Ewoyaa Lithium Project in Ghana, which is expected to be the primary feedstock for Tennessee Lithium, while Carolina Lithium continues to advance through permitting and approvals processes.

About Piedmont Lithium

Piedmont Lithium (Nasdaq:PLL; ASX:PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest. Our projects include our Carolina Lithium and Tennessee Lithium projects in the United States and partnerships in Quebec with Sayona Mining (ASX:SYA) and in Ghana with Atlantic Lithium (AIM:ALL; ASX:A11). These geographically diversified operations will enable us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage. For more information, follow us on Twitter @PiedmontLithium and visit www.piedmontlithium.com.

TENNESSEE LITHIUM DEFINITIVE FEASIBILITY STUDY

This Definitive Feasibility Study (“DFS”) of Piedmont Lithium’s (“Piedmont” or “the Company”) proposed Tennessee Lithium project (“Project” or “LHP-2”) is based on a 30,000 metric ton per year (“tpy”) lithium hydroxide (“LiOH”) conversion facility featuring the innovative and waste-reducing Metso:Outotec conversion technology, which eliminates acid roasting of spodumene and reduces solid waste generation compared to conventional technologies.

The Project is based on a 30-year operation. This DFS assumes operations achieve nameplate capacity within a 12-month period, including both overall production and battery quality production. Table 2 provides a summary of production and cost figures for the Project as well as a comparison to the preliminary economic assessment of the Company’s LHP-2 project completed in March 2022. While the DFS assumes feedstock from Piedmont’s project investments in Quebec and Ghana, it does not incorporate the profits expected to be derived from the Company’s offtake agreements or the economic interests held in Sayona Quebec, Sayona Mining, and Atlantic Lithium. Note: All values are reported in U.S. dollars.

Study Consultants

This Study combines information and assumptions provided by a range of independent consultants, including these key contributors:

Table 3: DFS Study Consultants | |

Consultant | Scope of Work |

Kiewit Engineering Group, Inc. | Front-end engineering design contractor |

Primero Group Americas Inc. | LiOH plant design and overall Study integration |

Metso:Outotec | LiOH manufacturing technology package |

HDR Engineering | Environmental and permitting support and project controls |

Carolina Material Technologies | Product packaging plant designer |

PLG Consulting | Spodumene logistics consultants |

Tennessee Lithium 30,000 tpy Lithium Hydroxide Plant Overview

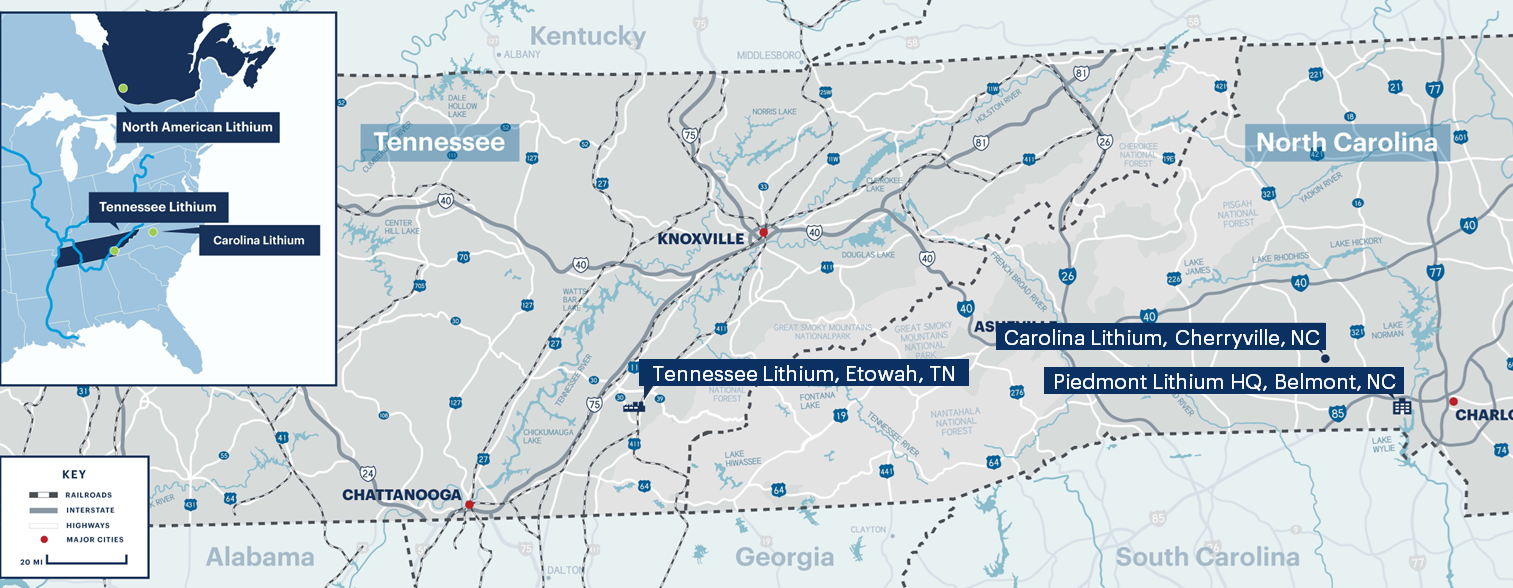

Tennessee Lithium will be located at the North Etowah Industrial Park in McMinn County, Tennessee. Piedmont agreed to purchase the 279-acre site situated between Chattanooga and Knoxville in August 2022. Figure 1 shows Tennessee Lithium’s location relative to Piedmont’s headquarters and Carolina Lithium project in Gaston County, North Carolina.

The Project’s location in Tennessee was selected for several key reasons, including access to excellent infrastructure with convenient rail, road, and river transportation. The property is a CSX Select Site and a Select Tennessee Certified Site, ensuring that it meets high quality standards and is primed for development with documented environmental conditions and geotechnical analysis among other criteria. Further, the site is located in an Opportunity Zone, which gives Piedmont the ability to be a key contributor to the economic growth of the region.

The area also is home to a talented, industrial workforce with several nearby educational institutions to support workforce development objectives, including the Advanced Technologies Institute of Cleveland State Community College and the Tennessee College of Applied Technology – Athens.

Responsible power sources were another key criterion in the site selection process. Tennessee rated highly in this category due to the Tennessee Valley Authority’s aspiration to be net zero by 2050 and its commitment to replacing coal-fired generation with low-carbon resources, including nuclear, hydro, wind, and solar.

The site is in proximity to the “Battery Belt,” where battery and automotive plants are being constructed by prospective customers, and it is situated within a constructive business climate with cooperative local and state governments.

Figure 2 highlights examples of regional infrastructure as well as industries neighboring the industrial park.

The DFS assumes that Tennessee Lithium will operate for 30 years and produce 30,000 tpy of lithium hydroxide at steady state from approximately 196,000 tpy of 6% Li2O spodumene concentrate (“SC6”) purchased at market rates from third parties. To support Tennessee Lithium operations, our strategy is to work with Atlantic Lithium to develop the Ewoyaa Lithium Project (“Ewoyaa”) in Ghana, where Piedmont holds offtake rights to 50% of spodumene concentrate production on a life-of-mine basis. Atlantic Lithium submitted an application for mining license to the Minerals Commission of Ghana for Ewoyaa in 2022 and expects to complete a definitive feasibility study in 2023 for the project.

In addition, spodumene concentrate may be purchased from Sayona Quebec, where Piedmont holds offtake rights for the greater of 113,000 tpy or 50% of spodumene concentrate production on a life-of-mine basis from North American Lithium (“NAL”) and the Authier Lithium Project. NAL restarted spodumene concentrate production in Q1 2023 and is expected to begin commercial shipments as early as Q3 2023.

While the strategy of the Company is to align operations in Tennessee Lithium primarily with the supply of spodumene concentrate from Ghana and secondarily with the supply from North American Lithium, the Project has the potential to accept spodumene concentrate from other market sources.

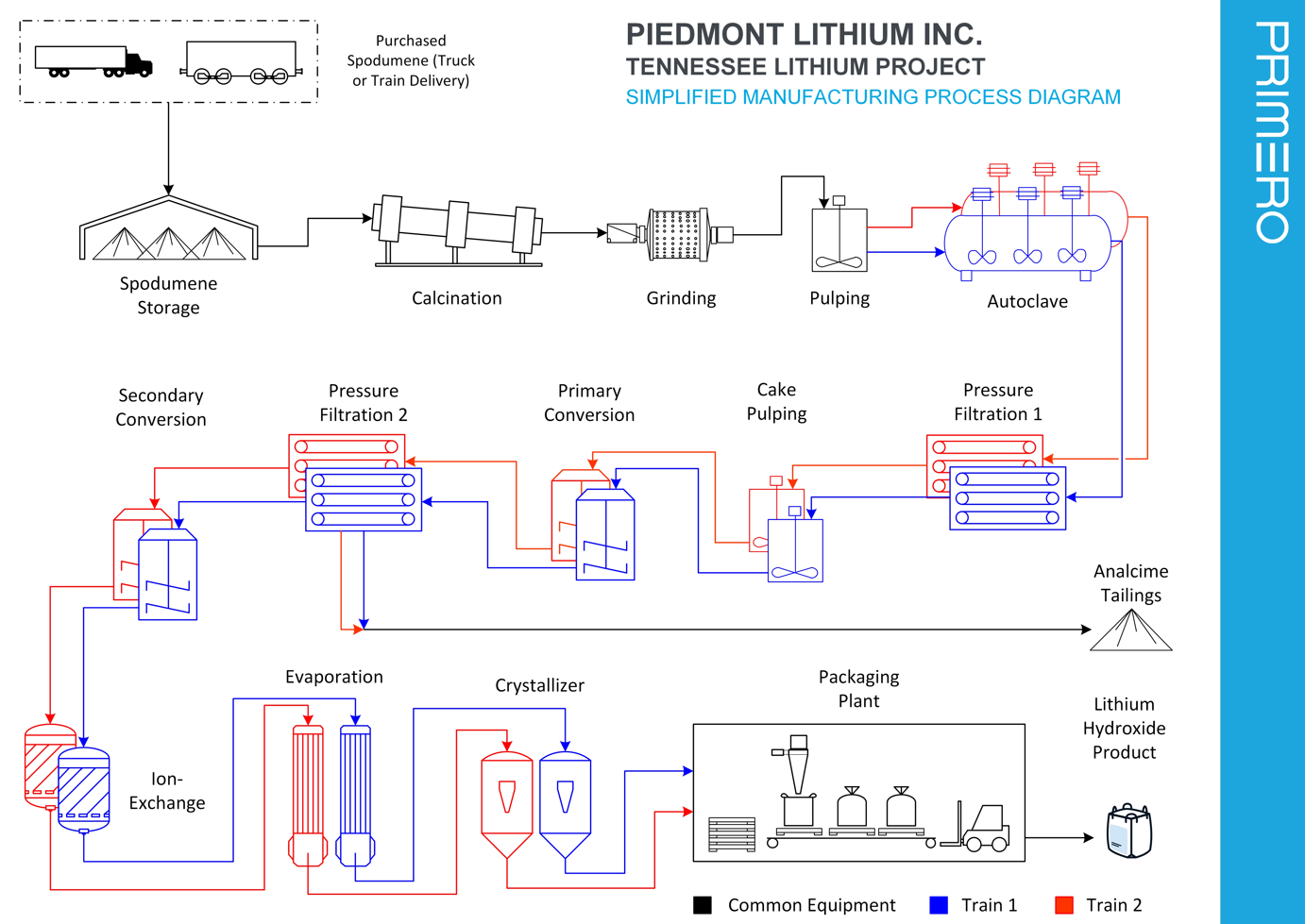

Process Design

Piedmont has selected Metso:Outotec’s innovative and proprietary alkaline pressure leach process, rather than traditional acid roasting, for production of lithium hydroxide at Tennessee Lithium. By eliminating the use of sulfuric acid, the pressure leach process is expected to reduce solid waste generation and overall air emissions. We believe our entire conversion method will be more efficient and environmentally sustainable than conventional acid-roasting spodumene-to-hydroxide technologies, resulting in a process that is safer for employees, the environment, and the community. While Metso:Outotec’s pressure leach process is new to the lithium industry, it has been proven in other applications, and we expect it will be adopted and proven by other lithium producers ahead of our timeline. All other unit operations, excluding the pressure leach within the process flowsheet, are currently widely employed in the lithium industry.

In 2021, Piedmont engaged Metso:Outotec to undertake pilot plant testwork using their pressure leach process based upon a spodumene concentrate sample derived from the Carolina Lithium project. In September 2022, Metso:Outotec began additional bench scale alkaline pressure leach testwork using spodumene concentrate samples sourced from Ewoyaa and NAL. Supplemental testwork on third-party concentrates is planned to support design basis and determine the impact of mineralogical/characteristic variability, however, the process is being designed to convert a wide variety of spodumene sources with minor adjustments. Based on the testwork completed, Metso:Outotec expects that 196,000 tpy of SC6 will be required to produce 30,000 tpy of battery quality lithium hydroxide, which allows this Study to assume a 91% lithium conversion rate through the lithium hydroxide conversion plant.

Site Plan

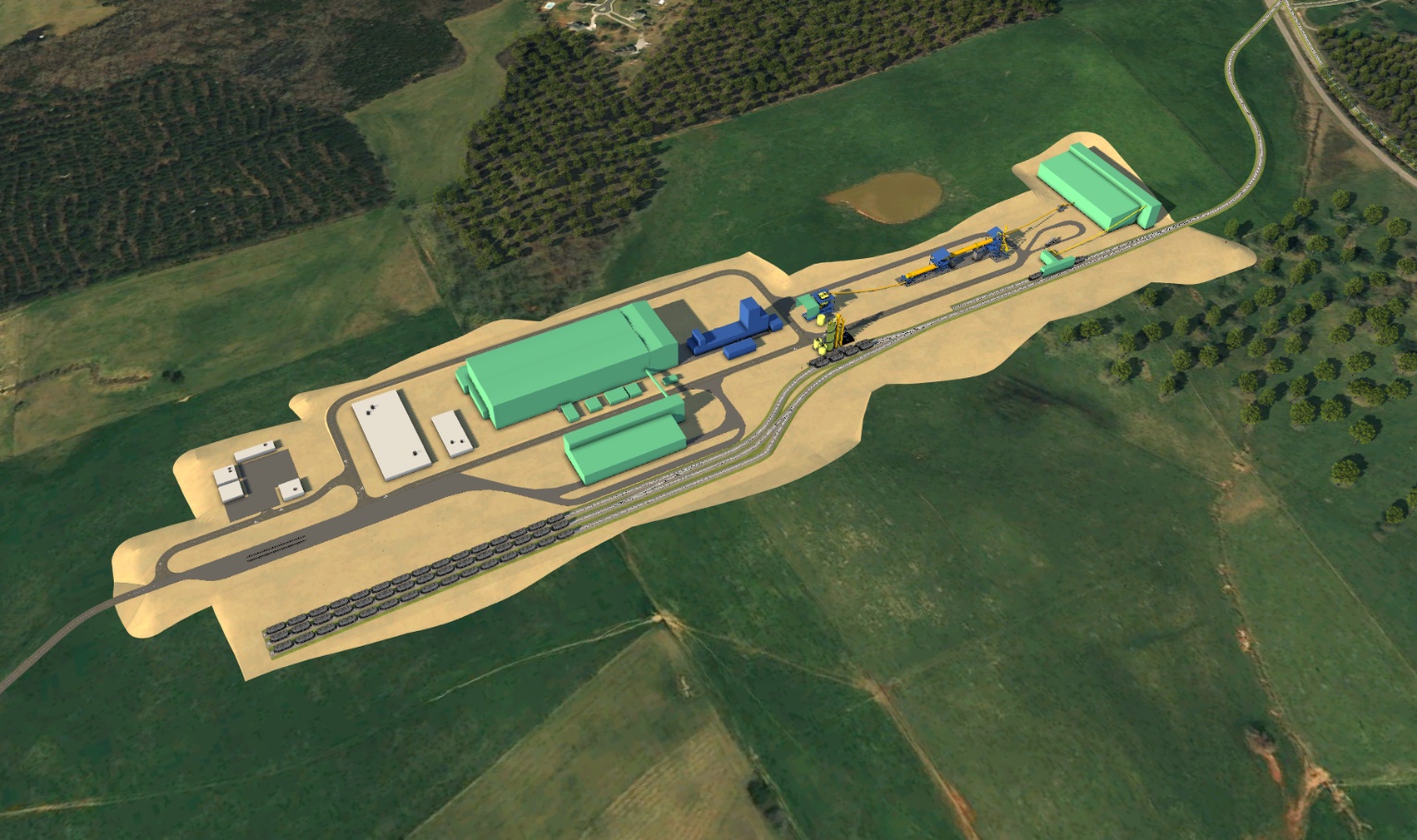

A preliminary site plan and 3D model (Figure 4) of the Tennessee Lithium plant, including lithium hydroxide manufacturing, rail siding, and ancillary facilities, was developed by Primero Group and Kiewit Engineering during the course of the Study. Layout optimization and value engineering are ongoing as part of front-end engineering design efforts.

Infrastructure

Transportation

The proposed Tennessee Lithium site is located in the North Etowah Industrial Park in McMinn County, approximately 3.5 miles north of Etowah, Tennessee, and 6 miles southeast of Athens, Tennessee.

Etowah is located between Chattanooga and Knoxville, Tennessee, along the I-75 Corridor. Secondary roads connect Etowah to Athens, the closest access point to the Interstate. US Highway 411 runs through the city, paralleling the Interstate.

The North Etowah Industrial Park is a CSX Select Site, and the CSX main line track is adjacent to the Tennessee Lithium property. The CSX Select Site program reviews the most capable manufacturing and distribution development properties along the CSX network that can rapidly utilize freight rail service. The designation confirms that standard land use issues have been addressed and the site is ready for development.

Additionally, the site is in proximity to the Hiwassee River, which could provide an option for barge transportation via the Tennessee River system.

Power

Power supply to the site will be via a 161kV transmission line tap on the Tennessee Valley Authority (“TVA”) transmission system. The line tap will be provided by Etowah Utilities and will connect to a new local substation on the Project site. The substation will have the main step-down transformers to reduce voltage from 161kV to 13.8kV for power distribution on site.

The Project is expected to purchase power from the City of Etowah via an existing distributor contract that Etowah has with TVA. The Company has entered into a deposit agreement with TVA with respect to providing preliminary engineering design of a special delivery point to the Project’s planned substation.

TVA has transformed its power generation mix from 36% carbon free in 2005 to 57% carbon free in 2020, while reducing carbon emissions by 70% during that time period. TVA reduced its reliance on coal-fired power from 57% in 2005 to 15% in 2020[2] as part of that change in the generation mix. TVA also offers industrial customers the opportunity to partner in green energy programs, including TVA Green Flex and TVA Green Invest.[3] Piedmont continues to evaluate these programs as opportunities to improve our overall emissions profile.

Waste Disposal Facilities

The study assumes that Piedmont will construct or acquire a storage facility for the analcime tailings from the pressure leach conversion process. These costs are included in the initial capital costs of the Project. The DFS also includes estimated costs to operate this facility as well as sustaining capital for storage facility maintenance and expansion during the 30-year Project life.

Piedmont continues to work with potential regional partners that could repurpose the analcime tailings for beneficial uses to reduce the Project’s solid waste profile and further lower production costs.

Natural Gas

The Company has entered into agreements securing capacity reservations for natural gas supply from the City of Etowah for firm-primary supply of 500 dekatherm/day of natural gas and a secondary capacity reservation of 4,350 dekatherm/day from Symmetry Energy Solutions. Excess natural gas requirements above these amounts will be provided by Symmetry Energy Solutions, if required.

Logistics

Piedmont commissioned PLG Consulting (“PLG”) to evaluate various logistics alternatives for delivery of spodumene concentrate to Tennessee Lithium. PLG studied over 20 modal options for spodumene concentrate delivery to Etowah, Tennessee, including nine ocean ports and terminals, two river terminals, six barge operators, two stevedoring companies, three railroads, and truck delivery.

Based on PLG’s analysis, the Study has assumed that spodumene concentrate can be delivered by rail from several U.S. East Coast or Gulf ports and delivered by rail or truck to Etowah, Tennessee with barge transportation as an alternate delivery option.

Permitting

As a Select Tennessee Certified Site, the property had already undergone a range of evaluations and analysis prior to Piedmont’s site selection to ensure that it is primed for development. The location within the North Etowah Industrial Park reduces the number of permits and approvals that Piedmont will need to independently secure to commence construction and operations at Tennessee Lithium.

In October 2022, the Company submitted an application for a Conditional Major Non-Title V Air Permit to the Tennessee Department of Environment and Conservation (“TDEC”). TDEC requested additional information related to our application in November 2022, and we responded in December 2022. In February 2023, TDEC deemed our application complete and subject to ongoing review. The Company also submitted a Construction Stormwater permit for the Project in March 2023. We expect to receive these permit approvals in Q2 or Q3 2023, allowing construction to commence once project financing has been arranged.

Certain height variances for structures may be required from McMinn County or the City of Etowah for the Project, depending on the final engineering design. Piedmont is currently collaborating with local officials and emergency response representatives regarding the potential requirements.

Marketing

Lithium Market Outlook

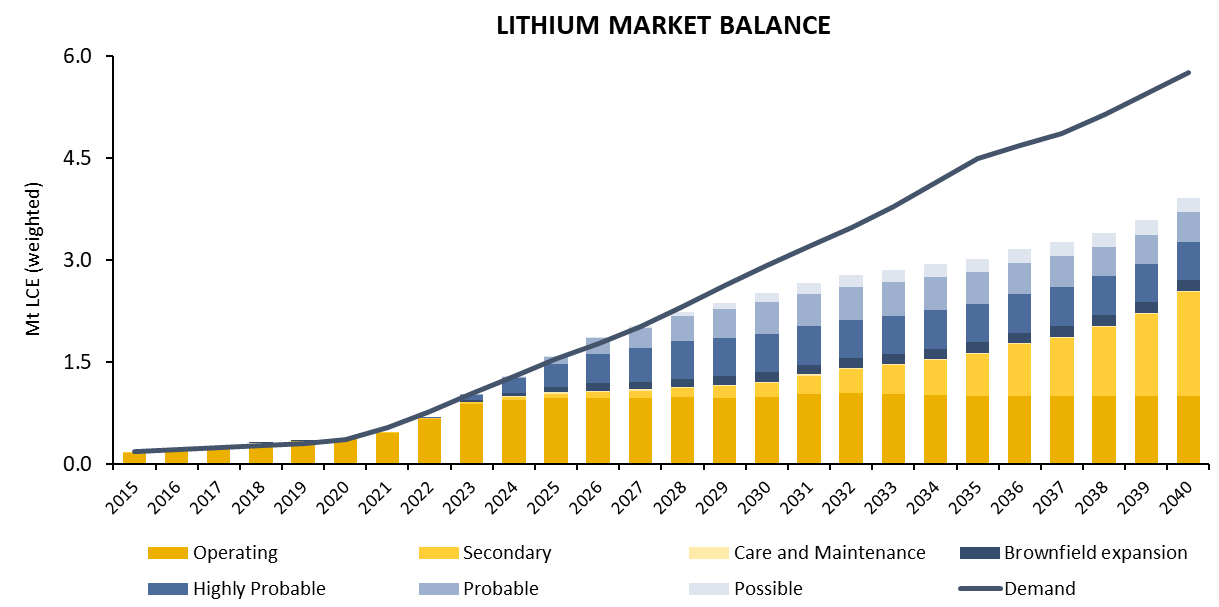

Benchmark Mineral Intelligence (“Benchmark”) reports that total battery demand grew to nearly 590 GWh in 2022 translating to 540kt of lithium carbonate equivalent (“LCE”) demand in 2022, a growth of 55% over 2021 demand. Benchmark calculated total demand in 2022 to be 672kt on an LCE basis. Benchmark further expects the market to remain in a structural deficit (see Figure 5) as demand outpaces supply. In the near impossible scenario that all projects come online on time and as planned, without any issues, Benchmark projects a modest surplus in 2025-2027 before the market returns to a perpetual deficit without further new projects yet undiscovered or developed.

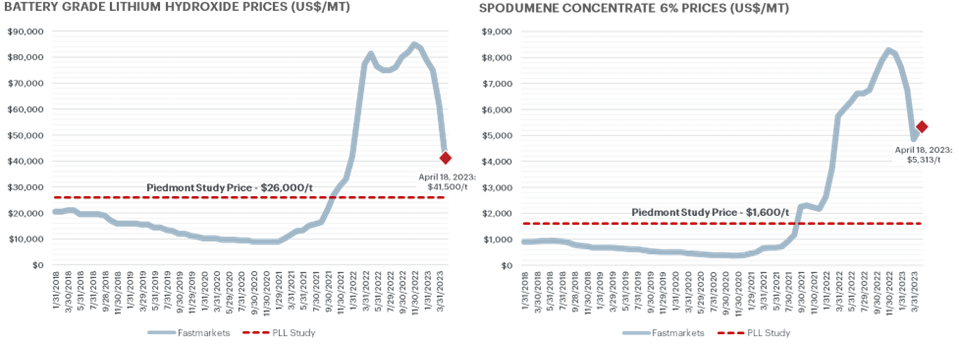

Lithium prices have experienced volatility since Piedmont published the preliminary economic assessment (“PEA”) for LHP-2 (now referred to as Tennessee Lithium) in March 2022. Prices continue to show volatility, but current spot prices for battery-grade lithium hydroxide and spodumene concentrate remain above historical averages. Since the PEA was published, market analysts and industry consultants have largely revised their price forecasts for lithium hydroxide and spodumene concentrate higher over both the medium- and long-term to account for changing industry dynamics.

This Study assumes flat prices of $26,000/t for battery-grade lithium hydroxide and $1,600/t for spodumene concentrate for the life of the Project. The selected price deck represents a discount to current spot market prices and recorded sale prices disclosed by operating companies in the space. The price forecasts were developed based on a basket of market analysts and industry consultant medium- and long-term price forecasts, in addition to internal expectations around the future pricing environment. We believe that prices should remain elevated for several years based on increasing demand for lithium-ion batteries, a shortage of qualified supply, and the emergence of high-cost lepidolite and other alternative supply sources. Figure 6 compares the pricing used in the Study to historical pricing for lithium hydroxide and spodumene concentrate.

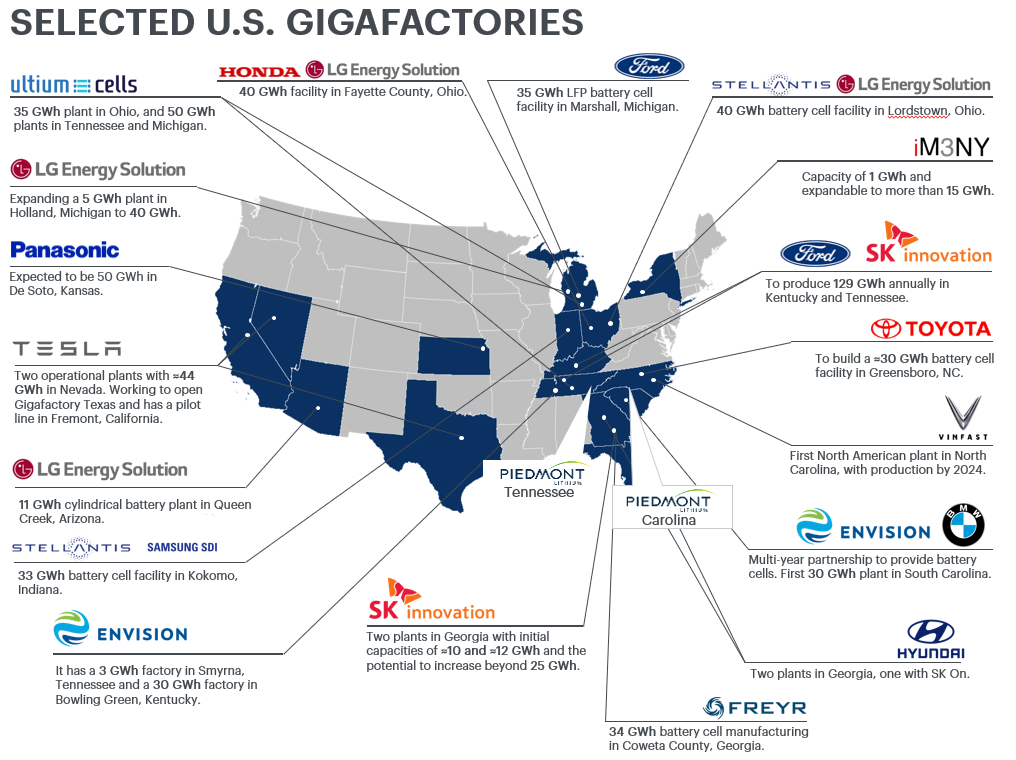

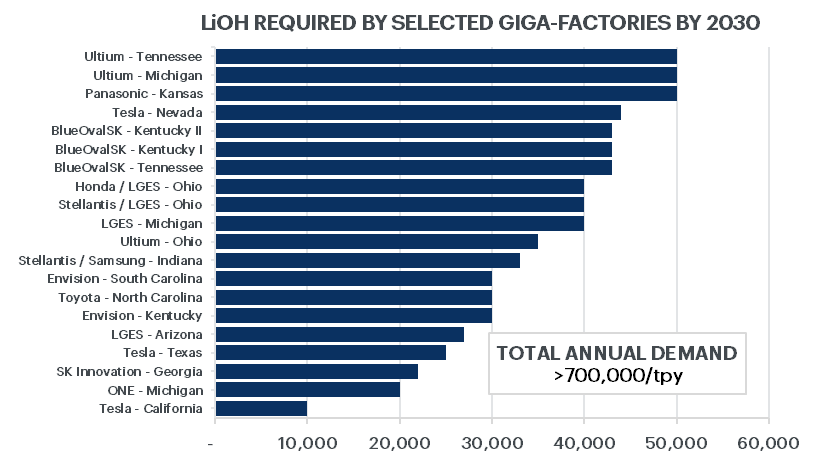

As shown in Figure 7 below, North America is seeing considerable growth in battery plant capacity. Figure 8 below shows the corresponding lithium hydroxide demand given the expected capacity of the announced U.S. battery manufacturing plants at full production, reflecting dramatic growth from the current installed capacity base in the U.S. of approximately 20,000 tpy.

Market Strategy

Piedmont is focused on establishing strategic partnerships with customers for battery grade lithium hydroxide with an emphasis on a customer base that supports EV demand growth in North America and Europe. Piedmont expects to concentrate this effort on these growing EV supply chains, particularly considering the increasing commitments of battery and battery material manufacturing by groups such as Tesla, Ford, General Motors, Stellantis, Volkswagen, Toyota, LG Energy Solutions, LG Chem, SK Innovation, Samsung SDI, and others. Discussions with prospective customers and strategic parties are ongoing.

Operating and Capital Costs

Operating Cost Estimates

The operating cost estimate was prepared based on producing 30,000 tpy of lithium hydroxide monohydrate at Tennessee Lithium. Table 4 summarizes the estimated average operating costs during steady state operations and provides a comparison to the operating costs estimated in the PEA announced in March 2022.

The DFS operating cost estimate is based on Q4 2022 U.S. dollars with no inflation allowance. Target accuracy of the operating cost estimate is ±15%. Operating costs are based on steady state production.

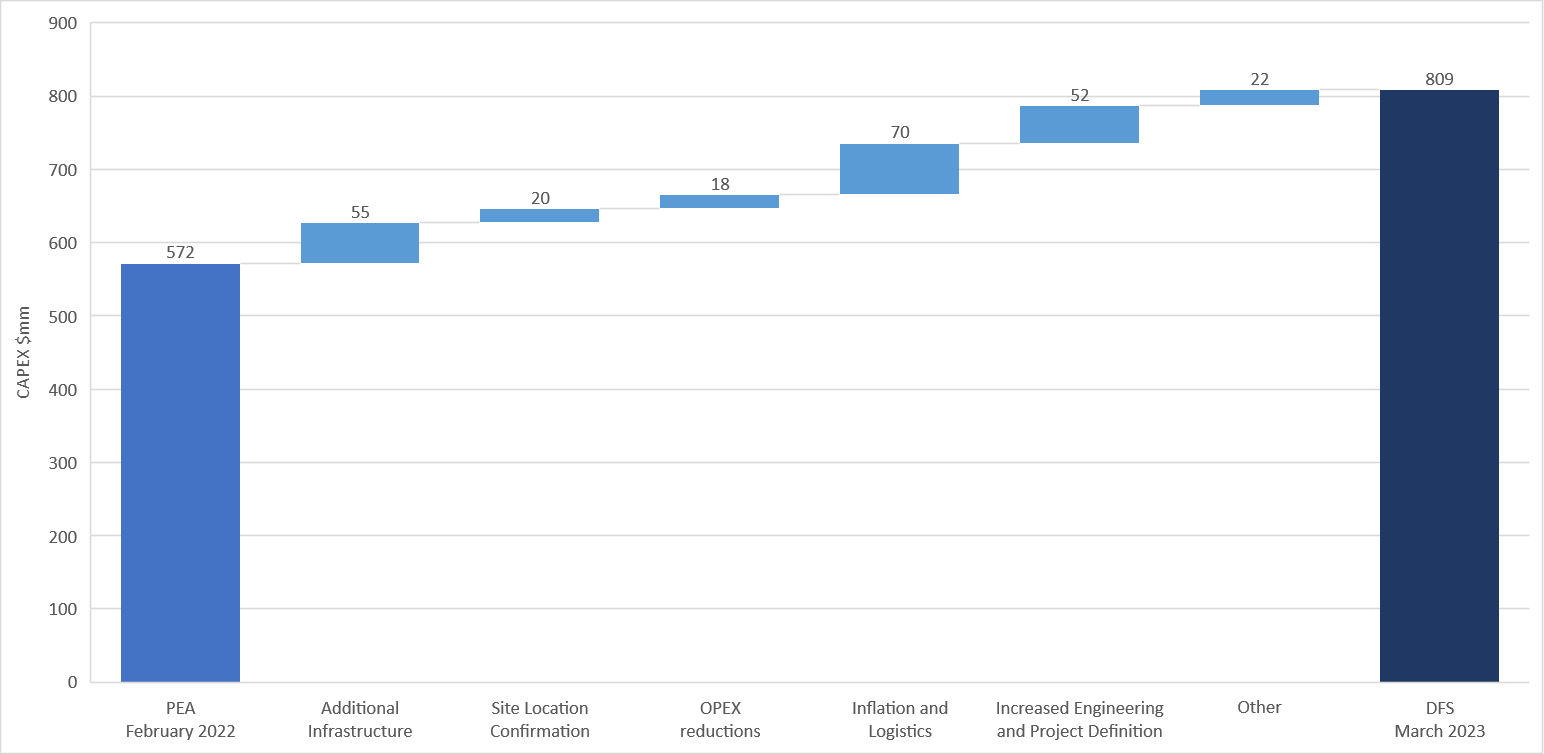

Capital Cost Estimates

Table 5 highlights the total estimated capital expenditures for the Tennessee Lithium project. Variable contingency has been applied to Project costs based on the level of engineering definition completed and the confidence level of supplier and contractor quotations. The capital cost estimate has a ±15% accuracy and is based on a Q4 2022 cost basis.

Figure 9 summarizes the significant CAPEX changes from the February 2022 PEA to the March 2023 DFS. The majority of the increases in CAPEX are due to inflation logistics and an increase in project definition.

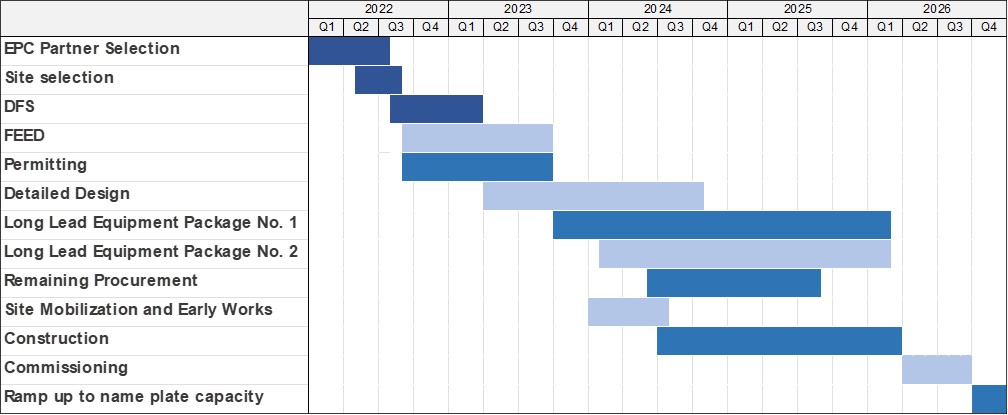

Project Schedule

Overall schedule development of the Tennessee Lithium project has been completed to a DFS level. An anticipated summary schedule is presented in Figure 10. Piedmont expects to complete front-end engineering design by the end of Q3 2023. Concurrent with completing FEED, Piedmont plans to begin detailed design engineering for the Project. Ordering of long-lead equipment and EPC execution will occur upon completion of permitting and project financing activities.

The Project schedule remains subject to ongoing design engineering, permitting approvals, spodumene concentrate supply sourcing, EPC contract negotiation, market conditions, and project financing activities.

Taxes and Depreciation

Tennessee Lithium project economics include, but are not limited to, the following key parameters related to taxes and depreciation allowances.

- Model assumes Tennessee state corporate taxes of 6.5%.

- The Federal tax rate of 21% is applied and state corporate taxes are deductible from this rate.

- Depreciation in the lithium hydroxide plant is based on Asset Class 28.0 – Mfg. of Chemical and Allied Products in Table B-1 using GDS of 5 years with the double-declining balance method.

- Bonus depreciation of 80% has been applied based on the bonus depreciation allowance in the Tax Cuts and Jobs Act of 2017, where applicable.

- A 10% production tax credit under Section 45X of the Inflation Reduction Act has been included in the financial model. The tax credit is applied to all operating costs, including spodumene concentrate purchases.

Modeling Assumptions

A project economical model was completed by Primero as part of the Study with the following key assumptions:

- Capital and operating costs are in accordance with technical study outcomes.

- Chemical plant ramp-up is based on a 12-month timeframe to nameplate production.

- Financial modeling has been completed on a yearly basis, including estimated cash flow for construction activities and Project ramp-up.

- Pricing information for battery-grade lithium hydroxide sales and spodumene concentrate supply are based on a fixed price of $26,000/t for battery quality lithium hydroxide and $1,600/t for 6.0% Li2O spodumene concentrate.

- Taxes and depreciation allowances according to stated assumptions.

Financial Modelling

The DFS assumes a chemical plant production life of 30 years as well as operations using market procurement of SC6, including potentially from offtake sources currently controlled by or contracted with Piedmont.

The current economic model is based on a yearly projection of capital costs and assumes that the full capital cost is spent across 2 years prior to commissioning the chemical plant. The chemical plant is assumed to ramp up to full production over a one-year period.

Payback Period

The payback period for Tennessee Lithium is estimated to be 2.8 years after the start of chemical plant operations or 5.3 years from the start of construction. The payback period is calculated based on after-tax free cash flow.

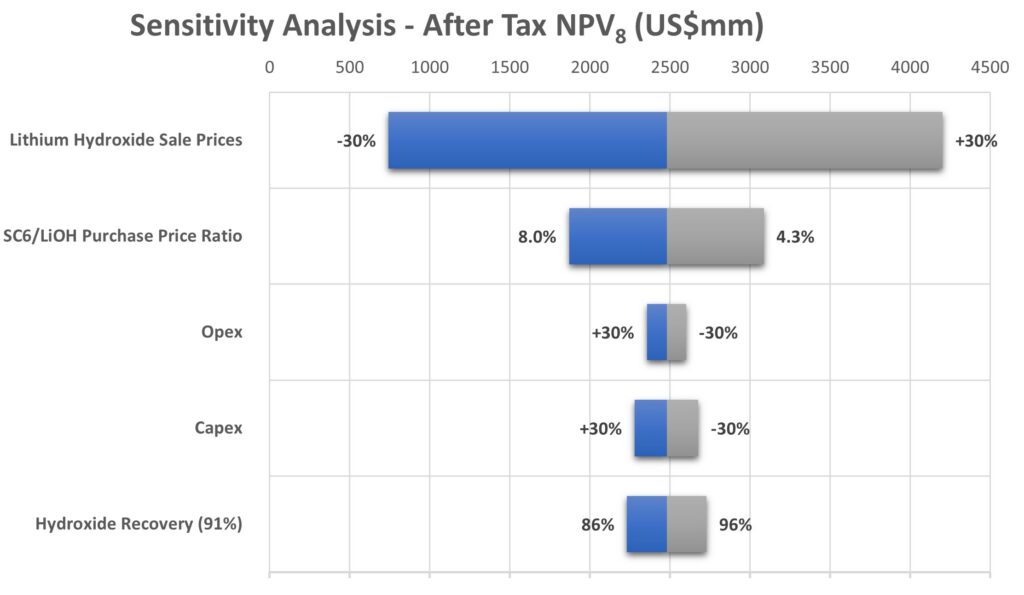

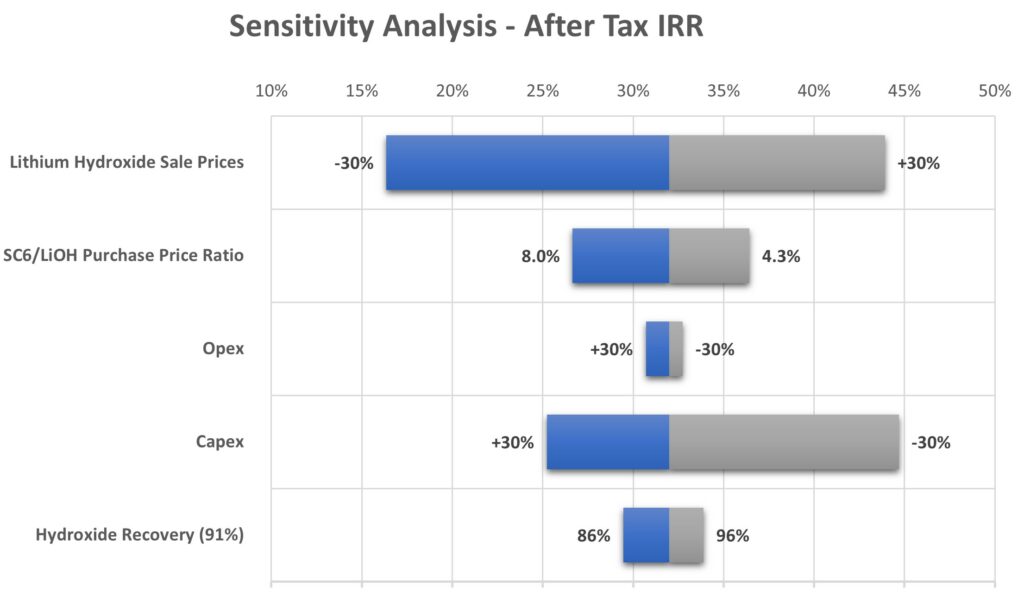

Sensitivity Analyses

Key inputs in the DFS have been tested by pricing, capital cost, and operating cost sensitivities. The impact to after-tax net present value (“NPV”) is presented in Figure 11, while the impact to Project internal rate of return is presented in Figure 12. Additionally, applying discount rates of 7% and 9% resulted in NPV7 of $2,851mm and NPV9 of $2,185mm.

Conclusions and Next Steps

The Tennessee Lithium DFS Study results demonstrate a robust technical and financial case for Piedmont to establish a merchant lithium hydroxide manufacturing business in the United States using spodumene concentrate from market sources, including the existing offtake agreements secured by the Company in 2021. The Company will now undertake the following activities with a view to a possible Final Investment Decision in 2024:

- Complete front-end engineering design.

- Continue permitting activities associated with the Project.

- Undertake additional pilot testwork programs with Metso:Outotec.

- Begin detailed design engineering.

- Continue project financing discussions.

1 The grant will not be final until Piedmont Lithium and the DOE have agreed to specific terms and conditions of the grant. Once terms and conditions are finalized, funding of the grant will remain subject to satisfaction of conditions set forth in those terms

2 https://www.tva.com/about-tva/learn-about-tva/environmental-leadership

3 https://www.tva.com/energy/valley-renewable-energy/renewables-for-large-business-and-industry

Forward Looking Statements

This announcement includes forward-looking statements within the meaning of applicable securities laws, including statements about LHP-2, the potential selection of a site for such plant, timing and expectations around any development and production of the plant and estimates and assumptions around permitting, revenues and costs of the plant. These forward-looking statements are based on Piedmont’s expectations and beliefs concerning future events. Such forward-looking statements concern Piedmont’s anticipated results and progress of its operations in future periods, planned exploration and, if warranted, development of its properties and plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “expect,” “estimate,” “may,” “might,” “will,” “could,” “can,” “shall,” “should,” “would,” “leading,” “objective,” “intend,” “contemplate,” “design,” “predict,” “potential,” “plan,” “target” and similar expressions are generally intended to identify forward-looking statements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements. Such factors include, among others, risks related to:

- the risk that anticipated plans, development, production, revenues or costs are not attained;

- Piedmont’s operations being further disrupted and Piedmont’s financial results being adversely affected by public health threats, including the novel coronavirus pandemic;

- Piedmont’s and its partners’ limited operating history in the lithium industry;

- Piedmont’s status as a development stage company, including Piedmont’s ability to identify lithium mineralization and achieve commercial lithium mining;

- risks of mining, exploration and mine construction, if warranted, on the properties of Piedmont and its partners, including timing and uncertainties related to acquiring and maintaining mining, exploration, environmental and other licenses, permits, access rights or approvals in Gaston County, North Carolina, the Province of Quebec, Canada and Cape Coast, Ghana as well as properties that Piedmont may acquire or obtain an equity interest in the future;

- completing required permitting activities required to commence processing operations for Tennessee Lithium;

- Piedmont’s ability to achieve and maintain profitability and to develop positive cash flows from Piedmont’s processing activities;

- risk around estimates of mineral reserves and resources of Piedmont and its partners and whether any such mineral resources will ever be developed into mineral reserves;

- investment risk and operational costs associated with exploration activities of Piedmont and its partners;

- the ability of Piedmont and its partners to develop and achieve production on their properties;

- Piedmont’s ability to enter into and deliver products under supply agreements;

- the pace of adoption and cost of developing electric transportation and storage technologies dependent upon lithium batteries;

- Piedmont’s ability to access capital and the financial markets;

- recruiting, training and developing employees;

- possible defects in title of Piedmont’s properties;

- compliance with government regulations;

- environmental liabilities and reclamation costs;

- estimates of and volatility in lithium prices or demand for lithium;

- Piedmont’s common stock price and trading volume volatility;

- the development of an active trading market for Piedmont’s common stock;

- Piedmont’s failure to successfully execute its growth strategy, including any delays in Piedmont’s planned future growth; and

- other factors set forth in Piedmont’s most recent Annual Report on Form 10-K and subsequent reports, as filed with the U. S. Securities and Exchange Commission.

All forward-looking statements reflect Piedmont’s beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures, including the amount, nature and sources of funding thereof, competitive advantages, business prospects and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections or other forward-looking statements will not occur. Although Piedmont have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. Piedmont cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the securities laws of the United States, Piedmont disclaims any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Piedmont qualifies all the forward-looking statements contained in this release by the foregoing cautionary statements