BELMONT, N.C. – Piedmont Lithium Inc. (Nasdaq: PLL) (ASX: PLL) (“Piedmont” or the “Company”) is pleased to provide an update on our recent accomplishments and development plans:

-

Carolina Lithium Project

-

Scoping update published in June 2021 contemplating 30,000 tonnes per year (“tpy”) lithium hydroxide production on a single integrated site in Gaston County, North Carolina

-

Superior sustainability profile vs. current producers in China and South America

-

Strong projected economics – ~$1.9bb NPV and ~$400mm steady-state EBITDA

-

Expected to employ ~500 people in well-paying jobs while making Gaston County a magnet for other businesses in the EV supply chain, and driving opportunities for a broad array of local small businesses

-

Definitive feasibility study expected in the second half of 2021

-

Permitting and approval process advancing

-

Clean Water Act Section 404 Standard Individual Permit received in 2019

-

Will apply for new air permit given the shift to a single site and the Metso Outotec process

-

Local approval process commenced in July 2021

-

North Carolina state mining permit application to be submitted in August 2021

-

Strategic Initiatives

- Canada – Sayona Quebec and North American Lithium (“NAL”)

-

Piedmont owns a 39.6% effective economic interest in Sayona Quebec

-

Sayona Quebec is poised to become Canada’s largest lithium project by resource tonnage with the completion of the acquisition of North American Lithium expected in August 2021

- Ghana – IronRidge Resources (“IRR”)

-

Piedmont is acquiring a 9.5% stake in IronRidge Resources (AIM: IRR) and may earn up to a 50% interest in IRR’s Ghanaian lithium portfolio

-

The Ewoyaa project is expected to have strong economics given its high-grade mineral resource, DMS-only process, low-cost hydro power, and close proximity to an international port

-

Piedmont has offtake agreements in place for 50% of spodumene concentrate production from Sayona/NAL and IRR Ghana, underpinning potential future growth in lithium hydroxide production

-

Corporate Matters

-

Piedmont redomiciled to become a US corporation in May 2021

-

Executive team bolstered with senior appointments including COO and CFO

-

Lithium offtake discussions ongoing with leading participants in the EV supply chain

-

Strategic partnering process underway and DOE ATVM loan application to be submitted in H2 2021

-

Cash balance of approximately $143 million as of June 30, 2021

Keith D. Phillips, President and Chief Executive Officer, said, “Piedmont is positioned to become a leading producer of lithium hydroxide while positively impacting the communities in which we operate by creating jobs, attracting other EV supply chain participants, increasing the tax base, and broadly supporting other local small businesses. Through direct investment and contracted offtake, we control a significant quantity of potential spodumene concentrate production in three critical locations. We believe spodumene is the preferred feedstock for the EV supply chain and that ‘owning the resource’ is the key to value creation in the lithium industry. We look forward to constructively engaging in the permitting and approval process for Carolina Lithium and driving further value for our shareholders by advancing the Quebec and Ghana projects toward development decisions.”

Carolina Lithium Project

On June 9, 2021, Piedmont Lithium published a Scoping Study Update which featured plans to construct a 30,000 tpy lithium hydroxide manufacturing business on a single campus in Gaston County, North Carolina.

The proposed Carolina Lithium Project has the potential for exceptional project economics. There are currently no such integrated sites operating anywhere in the world, and the economic and environmental advantages of this strategy are compelling:

-

Premier location in Gaston County, North Carolina – “the cradle of the lithium business”

-

Reduction of spodumene concentrate transportation costs and related noise and emissions

-

On-site solar power to lower costs and reduce reliance on diesel fueled equipment

-

Potential to co-locate other downstream battery materials / Li-ion battery manufacturing

-

Creation of approximately 500 manufacturing, engineering, and management jobs

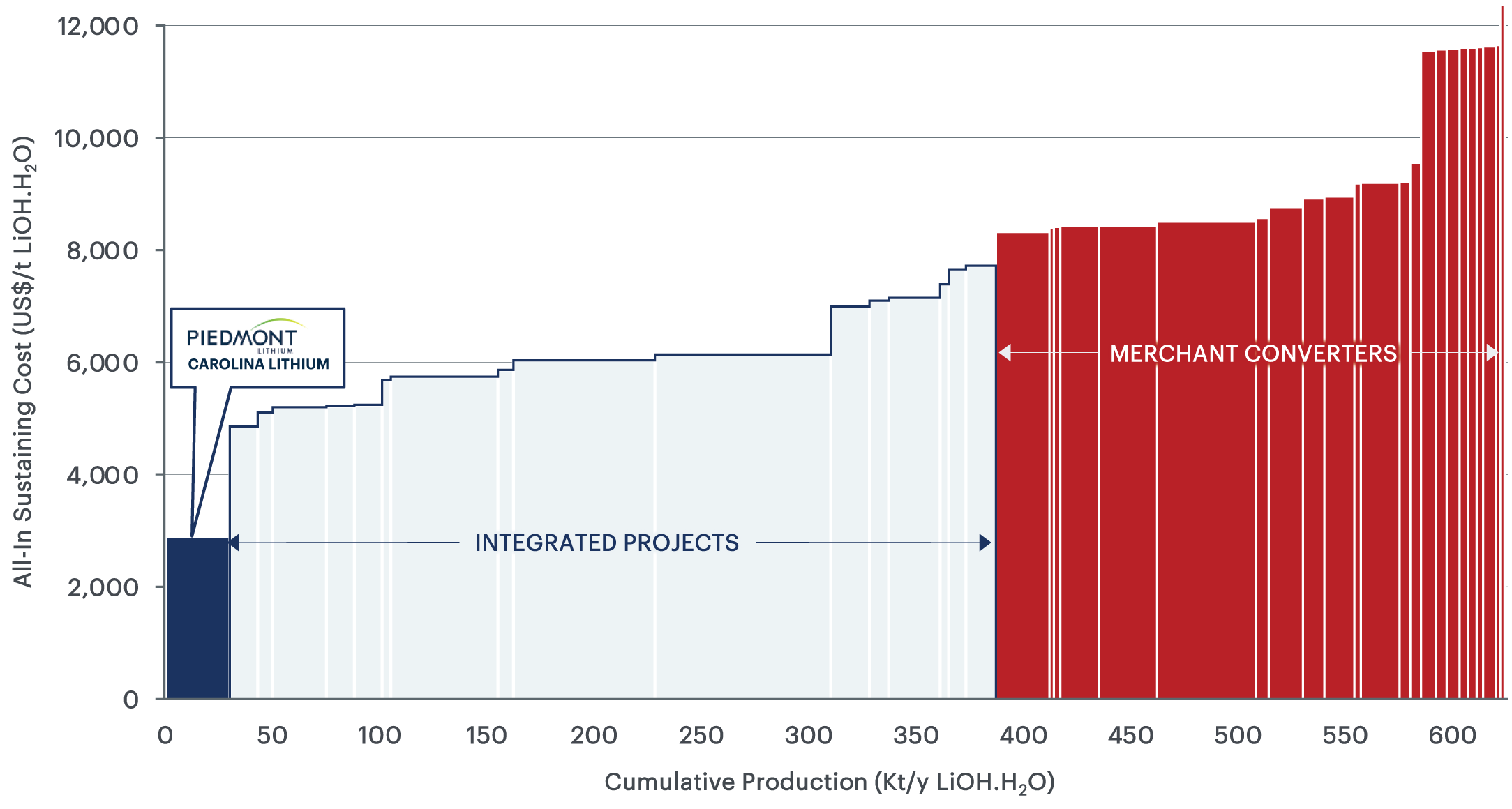

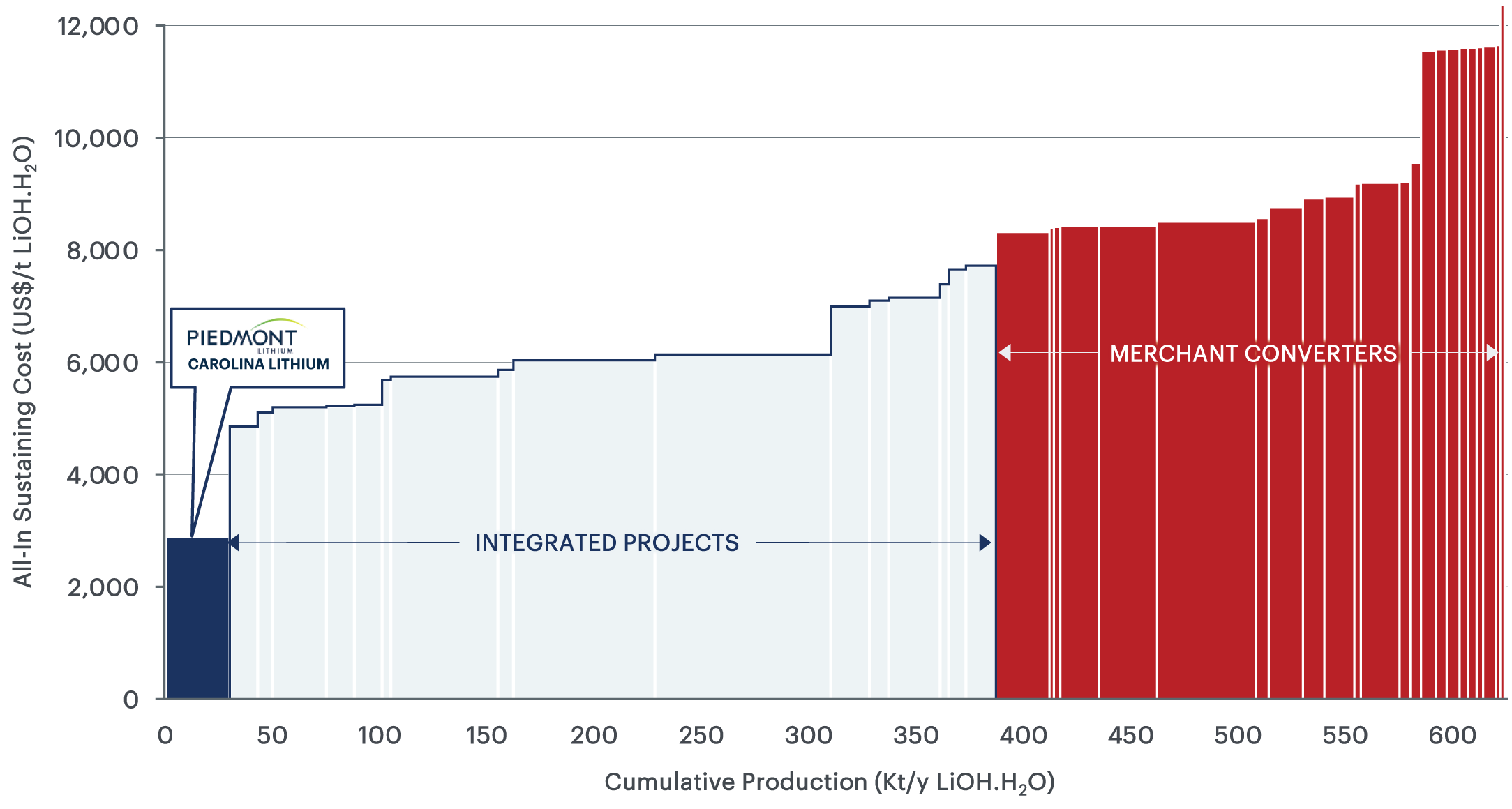

Figure 1 – Lithium hydroxide 2028 AISC cost curve (real basis) (Roskill)

AISC includes all direct and indirect operating costs including feedstock costs (internal AISC), refining, corporate G&A and selling expenses.

Community Impact

Piedmont Lithium expects to employ approximately 500 skilled local workers at an average $90,000 per year in salary and benefits, all in a safe, modern, state-of-the-art work environment.

Our Carolina Lithium Project will make Gaston County a North American leader in the electric vehicle supply chain and attract other supporting businesses that will generate quality jobs and increase tax revenue. Our operation will rely on the support of many small businesses in the area, including maintenance contractors, delivery drivers, caterers, machine shops, fabricators, uniform services, and many more. It will also enable and enrich the base of skilled manufacturing jobs and expand training programs in Gaston County.

Permitting Update

To date, Piedmont Lithium has obtained three important permits required to commence construction of our Carolina Lithium Project, including:

-

A Section 404 Standard Individual Permit issued by the US Army Corps of Engineers under the Clean Water Act, which included an Environmental Assessment resulting in a Finding of No Significant Impact

-

An Individual 401 Water Quality Certificate issued by North Carolina Division of Water Resources under the Clean Water Act

-

A Synthetic Minor Title V Air Permit issued by North Carolina Department of Environmental Quality (“NCDEQ”) – Division of Air Quality under the Clean Air Act

Additional permits or permit amendments will be required before construction can begin on the planned integrated Carolina Lithium operations. Remaining key permits include:

-

NC State Mining Permit issued by NCDEQ’s Division of Energy, Mineral and Land Resources (“DEMLR”)

-

Application for a new air permit due to the relocation of Piedmont Lithium’s planned lithium hydroxide manufacturing plant to Gaston County and the switch to the Metso Outotec process

-

A Conditional District rezoning approval from Gaston County approved by the Gaston County Board of Commissioners

The Company plans to submit its mine permit application to DEMLR in August 2021. After we submit the mine permit application and adjacent property owner notifications have been confirmed, then permit review will proceed through a structured process. This structured process includes a public comment period, review by DEMLR and other state agencies and divisions within NCDEQ, a potential public hearing, possible requests for additional information made by DEMLR, responses by Piedmont Lithium, and issuance of a draft permit.

Conditional district rezoning will require a recommendation by the Gaston County Planning Board and majority approval by the Gaston County Board of Commissioners. Piedmont Lithium expects to conduct multiple public information meetings as part of the rezoning process. The Company made an initial presentation of its integrated project plans to the Gaston County Board of Commissioners on July 20, 2021. The Company is in pre-application consultation with Gaston County at this time and coordinating with county officials with respect to future additional presentation dates.

Each of the DEMLR mine permit and county rezoning approvals will be mutually conditioned upon each other.

Definitive Feasibility Study and Project Timeline

Our Definitive Feasibility Study (“DFS”) of the 30,000 tpy integrated Carolina Lithium Project should be completed within the second half of 2021. The Company currently contemplates a start of construction in Q2 2022 subject to market conditions, project financing, and the successful conclusion of the permitting and approval processes, among other factors.

Canada – Sayona Quebec and North American Lithium

In January 2021, Piedmont Lithium entered into a strategic partnership with Sayona Mining Limited (“Sayona”) (ASX: SYA) through the purchase of an equity stake in Sayona and a 25% interest in its 100%-owned Quebec subsidiary, Sayona Quebec Inc (“Sayona Quebec”). Sayona Quebec owns the DFS-level Authier lithium project and the highly prospective Tansim exploration property, both located near the mining center of Val-d’Or, Quebec.

On June 30, 2021, the Superior Court of Quebec (Commercial Division) granted an approval and vesting order regarding the Company’s joint bid with Sayona for the acquisition of NAL, paving the way for Sayona Quebec to acquire all the shares and substantially all the assets of NAL. The transaction is expected to close in August 2021. NAL owns La Corne, a permitted, brownfield spodumene project located approximately 20 miles from Sayona’s core Authier project. La Corne has a Mineral Resource of 47.0Mt @ 1.19% Li2O and has had over $400 million invested in mining, concentrate and refining capacity. The project was operational and ramping toward nameplate production in 2018, when it was placed on care and maintenance due to weak lithium markets.

The combination of Authier and La Corne will create one of Canada’s largest lithium projects, all strategically located near the mining center of Val-d’Or in the Abitibi region of Quebec, with good proximity to rail and highway transportation networks as well as experienced mining and contracting talent. Piedmont will work closely with Sayona to upgrade the existing spodumene concentrate (“SC6”) plant and integrate the Authier ore body with La Corne. Piedmont has offtake agreements in place allowing the Company to purchase the greater of 113,000 tpy or 50% of annual SC6 production from the merged operation. We are evaluating options to build a conversion operation that could process Sayona SC6 as well as third-party SC6 into lithium hydroxide in Quebec, capitalizing on Quebec’s access to zero-carbon, low-cost hydropower, world-class infrastructure, and the initiative of the Quebec and Canadian governments to develop a local battery materials supply chain.

Mr. Phillips added, “Quebec is poised to become an important lithium production center and Piedmont Lithium is acquiring a significant stake in the province’s largest and best-located spodumene resource. We are developing plans for what could be a world-class Quebec-based lithium hydroxide business to complement our Carolina Lithium strategy.”

Ghana – IronRidge Resources

On July 1, 2021, Piedmont Lithium announced a strategic partnership with IronRidge Resources (AIM: IRR) through the purchase of an equity stake in IRR, staged project investments to earn a 50% interest in IRR’s Ghana-based lithium portfolio (“IRR Ghana”), and a binding supply agreement to purchase 50% of IRR Ghana’s planned SC6 production. IRR Ghana has an impressive portfolio of spodumene prospects, anchored by the highly promising Ewoyaa Project (“Ewoyaa”).

Ewoyaa has a current Mineral Resource of 14.5Mt @ 1.31% Li2O with substantial exploration upside, and we believe it has the potential to be a large, low-cost spodumene concentrate producer. In January 2021, IRR published a scoping study for Ewoyaa forecasting an average of 295,000 tpy of planned SC6 production, a $345 million after-tax net present value and an after-tax internal rate of return of 125%, for initial capital investment of $68 million. These anticipated project economics, if realized, would result in part from Ewoyaa’s location only 70 miles to the major port of Takoradi, direct access to clean solar and hydroelectric power, as well as the DMS-only process which is suitable for Ewoyaa’s coarse-grained spodumene.

Piedmont Lithium hopes to complete a definitive feasibility study for Ewoyaa by mid-2023 and to be producing spodumene concentrate by 2025. Piedmont Lithium believes its Ewoyaa offtake rights can underpin significant growth in its lithium hydroxide position and is currently evaluating possible conversion sites in North America.

“We believe Ewoyaa is an exceptional project with great upside. We believe it is Africa’s best-located lithium project and we look forward to working with our partners at IRR to update the mineral resources and economics at Ewoyaa and incorporate those into our future lithium hydroxide conversion plans in North America,” commented Mr. Phillips.

Corporate Matters

- Redomicile – In May 2021, Piedmont successfully completed a redomiciling process to become an American (Delaware) corporation headquartered in Gaston County, North Carolina, with a primary listing on Nasdaq and a secondary listing on the Australian Securities Exchange. The redomiciling process has helped attract U.S. institutional investor and analyst following of the Company, which we believe will drive higher shareholder value over time.

- Director and Officer Appointments – As part of our transition to becoming an American company we appointed Claude Demby and Susan Jones to our Board of Directors in May 2021, bringing two seasoned executives with substantial governance experience to help guide our Company. We have added several important members to our team over the past several months, highlighted by the appointments of David Klanecky, former head of Albemarle’s hard rock lithium business, as Chief Operating Officer, and Michael White as our Chief Financial Officer. Piedmont’s employee base is now 24 strong, including a talented technical team with deep experience in the lithium and mining industries.

- Financial Position – In March 2021 the Company completed a successful U.S. equity placement and our cash balance was approximately $143 million on June 30, 2021, our fiscal year end. We believe our cash position is sufficient to fund our global pre-construction activities at least through the end of 2022.

- Project Financing – In June 2021, we commenced a process to engage with potential strategic partners for the equity funding of the Carolina Lithium Project, and in September 2021 we plan to apply for project debt financing from the U.S. Department of Energy’s Advanced Technology Vehicle Manufacturing Loan program. These funding processes are expected to run in parallel with our permitting/approval process.

- Customer Relationships / Lithium Offtake – Piedmont maintains strong relationships with many of the leading participants in the electric vehicle supply chain, including cathode and battery manufacturers as well as automotive OEMs. The initial delivery dates contemplated in our existing spodumene concentrate sales agreement have been extended by mutual agreement.

- Legal – With respect to the recent class action lawsuit filed by a Piedmont Lithium shareholder, Piedmont believes this action to be entirely without merit and we will defend ourselves vigorously.

About Piedmont Lithium

Piedmont Lithium (Nasdaq: PLL; ASX: PLL) is developing a world-class integrated lithium business in the United States, enabling the transition to a net zero world and the creation of a clean energy economy in America. Our location in the renowned Carolina Tin Spodumene Belt of North Carolina, the cradle of the lithium industry, positions us to be one of the world’s lowest cost producers of lithium hydroxide, and the most strategically located to serve the fast-growing US electric vehicle supply chain. The unique geographic proximity of our resources, production operations and prospective customers places us on the path to be the most sustainable producer of lithium hydroxide in the world and should allow Piedmont to play a pivotal role in supporting America’s move to the electrification of transportation and energy storage. For more information, please visit www.piedmontlithium.com.

Forward Looking Statements

This announcement may include forward-looking statements within the meaning of securities legislation in the United States and Australia, including statements regarding current and future plans of Piedmont and its strategic partners; strategy; value; returns; capital allocation and investment; exploration, development and construction efforts and plans; and expectations regarding permitting, production, costs and expenses. These forward-looking statements are based on Piedmont’s expectations and beliefs of Piedmont and its strategic partners concerning future events. Forward looking statements are necessarily subject to known and unknown risks, uncertainties, and other factors, many of which are outside the control of Piedmont, which could cause actual timing, achievements, results and performance to differ materially from the future timing, achievements, results and performance implied by such statements. Such factors include, among others, hazards inherent in the mining business (including risks inherent to exploring, developing, constructing and operating mining projects), risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations and our ability to obtain necessary permits and approvals, as well as other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission and the Australian securities regulators, including, without limitation, our most recent reports on Form 10-K and Form 10-Q. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect new information or the circumstances or events after the date of that this announcement.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The Project’s Core Property Mineral Resource of 25.1Mt @ 1.13% Li2O comprises Indicated Mineral Resources of 12.5Mt @ 1.13% Li2O and Inferred Mineral Resources of 12.6Mt @ 1.04% Li2O. The Central property Mineral Resource of 2.80Mt @ 1.34% Li2O comprises Indicated Mineral Resources of 1.41Mt @ 1.38% Li2O and 1.39Mt @ 1.29% Li2O. The information contained in this announcement has been prepared in accordance with the requirements of the securities laws in effect in Australia, which differ from the requirements of U.S. securities laws. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Australian terms defined in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). However, these terms are not defined in Industry Guide 7 under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and are normally not permitted to be used in reports and filings with the U.S. Securities and Exchange Commission (“SEC”). Effective January 1, 2021, the SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, and as a result, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the JORC Code. However, information contained herein that describes Piedmont’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. U.S. investors are urged to consider closely the disclosure in Piedmont’s Form 20-F for the fiscal year ended June 30, 2020, a copy of which may be obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.

Competent Persons Statement

The information in this announcement that relates to Exploration Results, Metallurgical Testwork Results, Exploration Targets, Mineral Resources, Concentrator Process Design, Concentrator Capital Costs, Concentrator Operating Costs, Mining Engineering and Mining Schedule is extracted from the Company’s ASX announcements dated July 23, 2020, May 26, 2020, June 25, 2019, April 24, 2019, and September 6, 2018, which are available to view on the Company’s website at www.piedmontlithium.com. Piedmont confirms that: a) it is not aware of any new information or data that materially affects the information included in the original ASX announcements; b) all material assumptions and technical parameters underpinning Mineral Resources, Exploration Targets, Production Targets, and related forecast financial information derived from Production Targets included in the original ASX announcements continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially modified from the original ASX announcements.

For further information, contact: