STRATEGIC LANDHOLDING SECURED IN HISTORIC LITHIUM PRODUCING REGION IN USA

ANNOUNCEMENT TO THE AUSTRALIAN SECURITIES EXCHANGE | September 27, 2016 | ASX:WCP

160927_strategic-USA-landholding-secured-in-historic-lithium-producing-region.pdf

160927_strategic-USA-landholding-secured-in-historic-lithium-producing-region.pdf

- WCP has secured a core landholding position in the Carolina Lithium Belt (also referred to as the Carolina Tin-Spodumene Belt), a historic lithium producing region located in North Carolina, United States

- WCP’s Piedmont Lithium Project (“Project”) is located along trend from the historic Hallman-Beam (~6km south) and Kings Mountain (~17km south) lithium mines

- From the 1950’s to the 1990’s these two mines were the most important western world lithium producers and the only U.S. domestic source of lithium, and their metallurgy formed the foundation for the design of modern lithium processing facilities

- Albemarle Corp. (NYSE:ALB, market cap of A$11.9 billion) and FMC Corp. (NYSE:FMC, market cap of A$8.6 billion) operate the only two North American lithium downstream processing facilities, which are both located in close proximity to the Project and which

continue to be some of the largest producers of lithium products worldwide The Project was previously explored by FMC and more recently by North Arrow Minerals Inc., including 19 holes drilled in 2009/10, prior to changing its focus to gold and base metal opportunities due to the significant fall in lithium price in 2010 - WCP is currently in the process of acquiring this historical drill data and will update the market on the results of this prior exploration in the coming weeks

- Combination of unique proximity to downstream lithium infrastructure together with the growing U.S. demand for electric vehicle and battery storage markets, places WCP in a unique position to build a strategic U.S. domestic source of lithium production

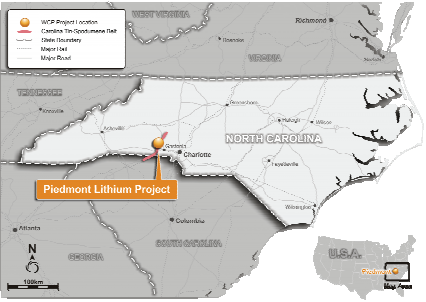

Figure 1: Project Location

WCP Resources Limited (“WCP” or “Company”) (ASX:WCP) is pleased to announce that it has commenced optioning surface and mineral rights through its recently formed subsidiary, Piedmont Lithium Inc., in the Carolina Lithium Belt, also referred to as the Carolina Tin-Spodumene Belt (“TSB”), a historic lithium producing district in North Carolina, United States (Figure 1).

The Company’s Piedmont Lithium Project (“Project”) comprises options over an initial core landholding of 415 contiguous acres in what is known historically as the Beaverdam area. In addition, the Company is in advanced discussions regarding the optioning of additional surface and mineral rights in the area.

The Board is also pleased to advise that resource company executive, Mr Taso Arima, will be appointed as an Executive Director of the Company, and experienced U.S. geologist, Mr Lamont Leatherman, will be appointed as Consulting Geologist to the Company.

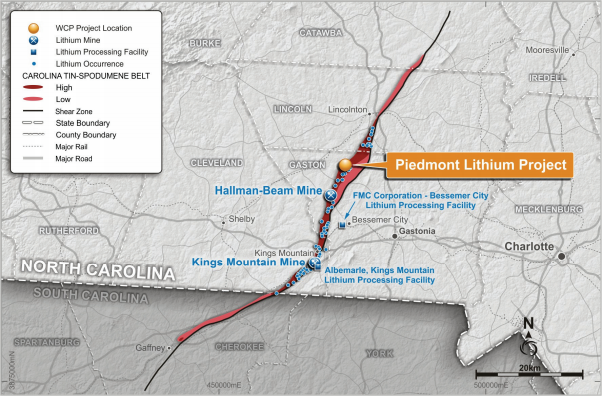

Figure 2: Project Location within the Carolina Tin-Spodumene Belt

The TSB has been recognised as one of the largest lithium provinces in the world and is located approximately 40 kilometres west of Charlotte, North Carolina, United States. The TSB was the most important lithium producing region in the western world prior to the establishment of the brine operations in Chile in the late 1990’s. The TSB is defined by a series of spodumene pegmatites occurring over a 60 kilometre long north-northeast trending zone. The maximum width of the zones is between 1 to 2 kilometres (Figure 2).

FMC Corporation (“FMC”) mined spodumene, a lithium bearing mineral, from pegmatite at the historic Hallman-Beam mine approximately 6 kilometres along trend to the south from the Project beginning in the 1950’s until the closing of the mine in 1998. Further along trend and approximately 17 kilometres to the south is the historic Kings Mountain lithium mine now owned by Albemarle Corporation (“Albemarle”) with its 800 acre site being described as one of the richest spodumene deposits in the world by Albemarle. These two mines and their respective metallurgy also formed the basis for the design of the two lithium processing facilities in the region which were the first modern spodumene processing facilities in the western world.

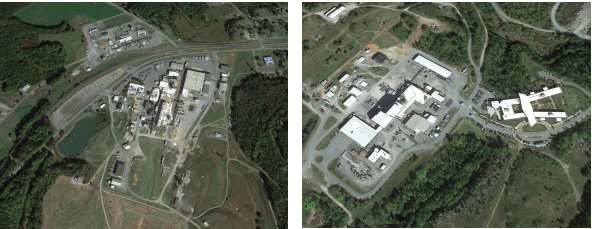

Albemarle and FMC continue to operate these important lithium processing facilities which are situated on these sites as a result of the rich deposits of lithium contained in the TSB (Figure 3). These facilities are now at the forefront of lithium research and development with FMC maintaining the Center for Lithium Energy Advanced Research (“CLEAR”) lab in Bessemer City, proximal to the Project. FMC’s Bessemer City lithium processing facility is approximately 14 kilometres from the Project whilst Albemarle’s Kings Mountain lithium processing facility is approximately 17 kilometres from the Project (Figure 2).

Figure 3: FMC and Albemarle Lithium Processing Facilities

The importance of the industry to not only the region but the U.S. economy is exemplified in its ability to attract federal funding. In 2012, the U.S. Department of Energy provided US$28.4 million in funding to Albemarle’s Kings Mountain facility expansion via the Recovery Act with further U.S. Department of Energy grants being proposed for research and development (“R&D”) of next-generation lithium products in the region. Importantly, the U.S. Department of Energy has also provided exploration funding in the past pursuant to the Vehicle Technologies Program of the Recovery Act which aims to support the development and deployment of advanced vehicle technologies, including advances in electric vehicles, engine efficiency, and lightweight materials.

The region is one of the premier localities in the world to be exploring for lithium pegmatites given its favourable geology and ideal location with easy access to infrastructure, power, R&D centres for lithium and battery storage, major high tech population centres and downstream lithium processing facilities. The Company is a first mover in restarting exploration in this historic lithium producing region and aims to develop a strategic, U.S. domestic source of lithium to supply the increasing electric vehicle and battery storage markets.

The Project is focused over an area that has been explored for lithium dating back to the 1950’s where it was originally explored by Lithium Corporation of America which eventually was acquired by FMC. Most recently, North Arrow Minerals Inc. explored the Project in 2009 and 2010, which completed 19 drill holes within the Project area, prior to North Arrow Minerals Inc. changing its focus to gold and base metal opportunities due to the significant fall in lithium price in 2010. The Company is currently in the process of acquiring this drill data and following review of the historical exploration data the Company expects to update the market with regards to the results over the coming weeks.

As previously advised, the Board of WCP has been pursuing new opportunities in the resources sector which would have the potential to add value to the Company and its shareholders by adding to and building upon the Company’s existing exploration assets in Yemen and Australia. The current cash position of WCP allows the Company to pursue exploration of the Project while also fulfilling the commitments of its existing exploration assets in Yemen and Australia.

Board and Management Additions

The Board is pleased to advise that, effective on or about 1 October 2016, resource company executive, Mr Taso Arima, will be appointed as an Executive Director of the Company, and experienced U.S. geologist, Mr Lamont Leatherman, will be appointed as Consulting Geologist to the Company. Messrs Arima and Leatherman were responsible for identifying the Project opportunity.

Mr Arima is a resource company executive with a strong history of identifying companymaking resource projects. He has extensive experience in the formation and development of resource projects in North America. Mr Arima is currently Executive Director of Paringa Resources Ltd which is developing a coal project in the U.S., and formerly Executive Director of Coalspur Mines Ltd, which is developing a coal project in Canada, and Prairie Mining Ltd, which is developing a coal project in Poland. Mr Arima was instrumental in the identification and acquisition of all of Paringa’s and Coalspur’s projects, as well as the corporate strategy and marketing of the companies. Mr Arima began his career as a resources analyst for a Perth based boutique investment banking firm where he specialised in assessing the technical and financial aspects of resource companies and their projects. He has previously worked in the hydrocarbon division at Worley Parsons Limited. He attended the University of Western Australia where he studied a Bachelor of Commerce and a Bachelor of Engineering.

Mr Leatherman is an experienced geologist with over 25 years of experience in mineral exploration. For the past 10 years, he has worked as an exploration geologist specializing in property scale geologic mapping for numerous junior exploration companies active in Canada, U.S., Mexico and Australia. This has led to extensive experience in geologic and structural controls for numerous styles of mineralisation including: lithium bearing pegmatite systems; high and low sulfidation epithermal gold systems; banded iron formation hosted gold systems; orogenic gold systems; archaean lode gold systems; porphyry hosted copper and precious metal systems; skarn systems and a variety of base metal systems. Mr Leatherman has worked as a project geologist for BHP Minerals and Noranda and has a BS in Geology from Appalachian State University located in North Carolina.

In consideration for introducing the Project opportunity to the Company and as an incentive for future performance, the Company has agreed to issue to Mr Arima, Mr Leatherman, and other consultants (or their nominees), a total of 16,500,000 unlisted options exercisable at $0.05 each and expiring 31 December 2019, 12,000,000 unlisted options exercisable at $0.10 each and expiring 31 December 2019, and 12,000,000 unlisted options exercisable at $0.15 each and expiring 31 December 2019.

Terms of Option Agreements

WCP, through its 100% owned U.S. subsidiary, Piedmont Lithium Inc., has entered into exclusive option agreements with local landowners, which upon exercise, allows the Company to purchase (or long term lease) approximately 415 acres of surface property and the associated mineral rights from the local landowners. Upon exercise, in the case of a purchase, the Company will pay cash consideration approximating 150% of the fair market value of the surface property at the time of exercise (excluding the value of any minerals). Upon exercise, in the case of a long term lease, the Company will pay annual rents of between US$225 to US$300 per acre.

During the option period, WCP has the exclusive right to access, enter, occupy and use the surface property for all purposes related to exploring for and evaluating all minerals (except hydrocarbons) in return for the Company making annual option payments to the local landowners. The annual option payments for the initial 415 acres of surface property total approximately US$165,000. The landowners will also retain a production royalty payable on production of ore from the property, based on a sliding scale between US$0.50 to US$1.50 per tonne of ore produced.

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on WCP’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of WCP, which could cause actual results to differ materially from such statements. WCP makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Competent Persons Statement

The information in this announcement that relates to Exploration Results is based on, and fairly represents, information compiled or reviewed by Mr Lamont Leatherman, a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy and Exploration’ (SME), a ‘Recognised Professional Organisation’ (RPO). Mr Leatherman is a consultant to the Company. Mr Leatherman has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Leatherman consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

For further information, contact:

President & CEO (elect)

T: +1 973 809 0505

Executive Director

T: +1 347 899 1522