NEW YORK – Piedmont Lithium Limited (“Piedmont” or “Company”) is pleased to announce its intention to re-domicile from Australia to the United States via a proposed Scheme of Arrangement (the “Scheme”), subject to shareholder, regulatory and court approvals.

If the Scheme is approved, Piedmont will move its primary listing from the Australian Securities Exchange (“ASX”) to the Nasdaq Capital Market (“Nasdaq”) and will retain an ASX listing via Chess Depositary Interests (“CDIs”).

To implement the re-domiciliation, Piedmont has entered into a Scheme Implementation Deed (“SID”) with Piedmont Lithium Inc., a newly formed Delaware corporation (“Piedmont USA”), which will become the ultimate parent company of the Piedmont group of companies following the implementation of the Scheme.

Pursuant to the Scheme:

- Holders of Piedmont ordinary shares will be entitled to receive one (1) CDI in Piedmont USA for each ordinary share held in Piedmont on the Scheme record date (with each CDI to represent 1/100th of a share of common stock in Piedmont USA); and

- Holders of Piedmont American Depositary Shares (“ADSs”) (each ADS currently represents 100 Piedmont ordinary shares) will be entitled to receive one (1) share of common stock in Piedmont USA for each ADS held in Piedmont on the Scheme record date.

The re-domiciliation is not expected to result in any material changes to Piedmont’s assets, management, operations, or strategy, and is expected to be structured on a tax-neutral basis to Piedmont and its shareholders.

Rationale for the Scheme

Piedmont’s Board of Directors believe that becoming a U.S. company will allow Piedmont to streamline its business operations given substantially all of our core assets and management team are currently in the United States and the re-domiciliation may deliver certain additional benefits to Piedmont and its shareholders, including:

- Increased attractiveness of Piedmont USA to a broader U.S. investor pool who previously could not invest in non-U.S. securities, leading to Piedmont being more fully valued over time by a greater number of investors;

- Improved access to lower-cost debt and equity capital in the U.S. markets, which are larger and more diverse than Australian capital markets, thus enabling future growth to be financed at a lower cost;

- Increased demand for Piedmont USA shares due to the Company’s expected inclusion in important U.S. stock market indices such as the Russell 2000 and the S&P Total Market; and

- A simplified corporate structure for potential future merger, sale or acquisition transactions, which may increase Piedmont’s attractiveness to potential merger partners, sellers or acquirers.

Board Recommendation

The Board will appoint an independent expert to assess if the Scheme is in the best interest of Piedmont’s shareholders. A report prepared by the independent expert will form part of the Scheme Booklet, which will contain detailed information regarding the Scheme. Piedmont encourages its shareholders to read the Scheme Booklet carefully.

The Directors of Piedmont unanimously recommend that Piedmont shareholders vote in favor of the Scheme and all of the Directors personally intend to vote all Piedmont shares in their control in favor of the Scheme, subject to the independent expert concluding that the Scheme is in the best interests of Piedmont shareholders.

Details of the Scheme Implementation

The implementation of the Scheme is subject to several customary conditions including the approval of Piedmont shareholders and the Federal Court of Australia, as well as other necessary regulatory approvals.

Full details of the terms and conditions of the Scheme are set out in the SID, a copy of which is attached to this announcement.

Indicative Timetable and Next Steps

Piedmont shareholders do not need to take any action at this time.

A Scheme Booklet containing, among other things, more detailed information relating to the Scheme, reasons for the directors’ recommendation, information on the Scheme Meeting and the Independent Expert’s Report is expected to be mailed to Piedmont shareholders in late January 2021.

Piedmont shareholders will be given the opportunity to vote on the Scheme at a Scheme Meeting expected to be held in March 2021 and, subject to the conditions of the Scheme being satisfied, the Scheme is expected to be implemented in March 2021. These dates are indicative and subject to change.

New Board Composition

As part of the re-domiciliation, the Company is pleased to announce that it has appointed U.S. Independent Director, Mr. Jeffrey Armstrong, as Independent Chairman of the Board, replacing Mr. Ian Middlemas who will resign as a Director. The Company will make additional changes to its Board to comply with U.S. requirements in due course.

Mr. Armstrong joined the Board in 2018 and resides in Charlotte, North Carolina. Mr. Armstrong has extensive financial services experience with major corporations and entrepreneurs alike. He has served as CEO of North Inlet Advisors for the past 11 years and previously served as Head of M&A and Corporate Finance at what is now Wells Fargo’s Investment Bank. Mr. Armstrong’s deep experience in complex corporate transactions will be ideal as Piedmont explores strategic opportunities to build and maximize shareholder value in coming years.

The Board would like to thank Mr. Middlemas for his dedication and leadership in progressing Piedmont from a junior explorer into a A$500 million dual-listed U.S. lithium developer with a world class resource base. Mr. Middlemas will be stepping back from some of his broader corporate responsibilities to deal with family health issues, and Piedmont’s transition to become a U.S. company marks an opportune time for this shift. Mr. Middlemas remains very supportive of Piedmont’s strategic growth plans and has informed Piedmont that he intends to remain a large shareholder of the Company going forward.

Keith D. Phillips, President and Chief Executive Officer, commented:

“I’m very pleased that Piedmont will become a U.S. corporation, reflecting the location of our core assets and management team, and joining industry leaders Albemarle and Livent as the only American domiciled and listed lithium company. Lithium has been identified by the federal government as a critical material for America’s national security, and this re-domiciling will cement Piedmont’s position as an important part of the U.S. supply chain.

“Since our initial Nasdaq listing in 2018 we have seen the proportion of U.S. investors in Piedmont grow substantially, so that currently most of our average daily trading volume occurs on Nasdaq. Despite this progress, numerous U.S. investors are unable to invest in non-U.S. companies, and this re-domiciling will meaningfully expand the pool of eligible investors in our Company. We hope that this additional shareholder demand, combined with the Company’s future inclusion in important U.S. indices such as the Russell 2000, will lead to increased shareholder value over time. We will of course maintain a strong presence in the Australian market via a continued ASX listing, reflecting the strong support we have received from Australian institutional and individual shareholders over the past several years.

“I want to thank Ian Middlemas for his strong leadership and personal mentoring during the time I’ve been with Piedmont. Ian is a renowned entrepreneur and industrialist, and his focus on measured growth combined with prudent cash management have been critical to our success as an organization. I further want to welcome and congratulate Jeff Armstrong for his appointment as Chairman. Jeff is a seasoned strategic thinker and is well-established in the Charlotte community. I am confident he will be a strong leader of our Board going forward.”

About Piedmont Lithium

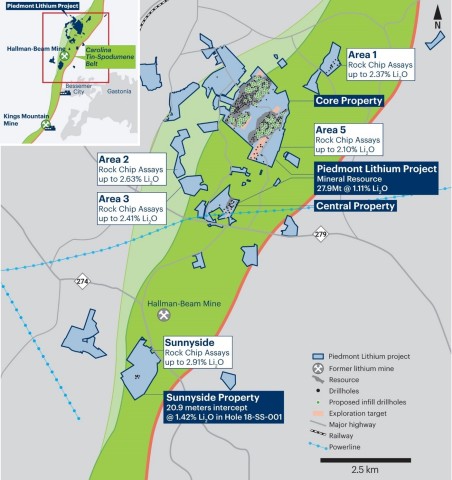

Piedmont Lithium Limited (ASX:PLL; Nasdaq:PLL) holds a 100% interest in the Piedmont Lithium Project, a pre-production business targeting the production of 160,000 t/y of spodumene concentrate and 22,700 t/y of battery quality lithium hydroxide in North Carolina, USA to support electric vehicle and battery supply chains in the United States and globally. Piedmont’s premier southeastern U.S. location is advantaged by favorable geology, proven metallurgy and easy access to infrastructure, power, R&D centers for lithium and battery storage, major high-tech population centers and downstream lithium processing facilities. Piedmont has reported 27.9Mt of Mineral Resources grading at 1.11% Li2O located within the world-class Carolina Tin-Spodumene Belt (“TSB”) and along trend to the Hallman Beam and Kings Mountain mines, which historically provided most of the western world’s lithium between the 1950s and the 1980s. The TSB has been described as one of the largest lithium provinces in the world and is located approximately 25 miles west of Charlotte, North Carolina.

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on Piedmont’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Piedmont, which could cause actual results to differ materially from such statements. Piedmont makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Not an offer of securities

This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States. Any securities described in this announcement have not been registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United States absent registration or in transactions exempt from registration under the U.S. Securities Act and applicable U.S. state securities laws.

This announcement has been authorized for release by the Company’s CEO, Mr. Keith Phillips.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201209005171/en/

Keith Phillips

President & CEO

+1 973 809 0505

Tim McKenna

Investor and Government Relations

+1 732 331 6457