- Land position increased by a further 15% to 2,105 acres

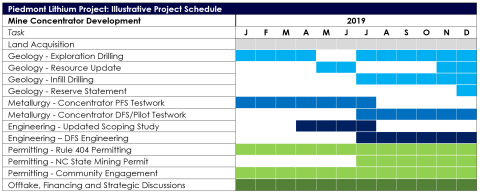

- Initial Mineral Resource estimate at Central property expected in

April 2019 - Updated Mineral Resource estimate for Core property expected in

June/July 2019 - Pre-Feasibility Study (“PFS”)-level metallurgical testwork ongoing

at SGS Lakefield - Updated Scoping Study based on updated resource and engineering

targeted for July 2019 - Definitive Feasibility Study and permitting approvals both on-track

for year-end 2019 - Company currently evaluating a range of offtake, financing and

strategic alternatives

NEW YORK – Piedmont Lithium Limited (“Piedmont” or “Company”) is pleased to

provide an update on the development of the Company’s 100% owned

Piedmont Lithium Project (“Project”) in the Carolina

Tin-Spodumene Belt (“TSB“) in North Carolina, United States. The

Company remains on schedule to update its Mineral Resource estimate and

Scoping Study near mid-year; to receive required permits and regulatory

approvals by year-end; and to complete a Definitive Feasibility Study (“DFS“)

by the end of 2019.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190408005847/en/

(Graphic: Business Wire)

Keith D. Phillips, President and Chief Executive Officer, said, “We

continue to make good progress in several areas critical to our

strategy, and remain on-track to begin construction in early-2020,

consistent with the schedule we established in late-2017.As the

only conventional lithium project in the USA, we have attracted

considerable strategic interest and have engaged in initial

conversations with parties in the lithium, mining, chemicals, battery,

automotive, and private equity sectors.We plan to appoint

financial and legal advisors in the coming weeks to assist in the

evaluation of strategic and financial plans as we approach a

construction decision.”

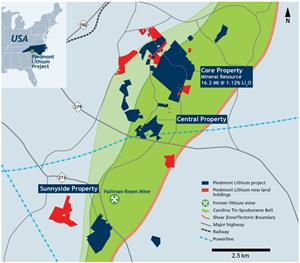

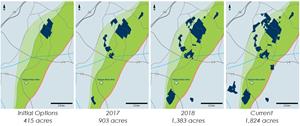

Continued Land Acquisition

The Company has recently increased its overall land position by 15% to

2,105 acres. The Company’s Core Property now comprises 1,004 acres,

representing an 86% increase from the Core land position underlying the

maiden Mineral Resource estimate.

PFS-Level Metallurgical Testwork Ongoing

Testwork evaluating Dense Medium Separation (“DMS”) technology

remains ongoing at SGS. Preliminary DMS results indicate the potential

to include DMS circuitry in the Piedmont concentrator’s design. Final

results of DMS testwork are expected in May 2019 and locked-cycle

flotation tests will also be performed. The results of the testwork

program will be used to update the process design from the Scoping Study

and to design a pilot program for later in 2019.

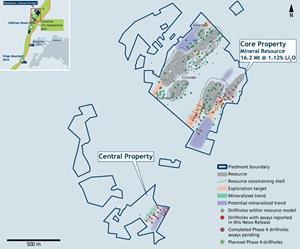

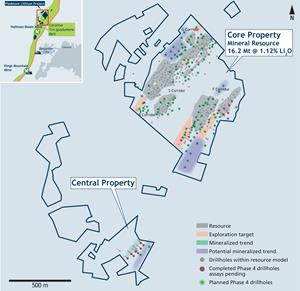

Resource Updates Expected in 2019

Piedmont’s Phase 4 drill campaign continues with three rigs actively

drilling. The Company expects that Phase 4 drilling will result in an

initial Mineral Resource estimate on the Company’s Central Property in

April 2019 and an update to the Mineral Resource estimate on the

Company’s Core Property in June/July 2019.

Technical Studies Underway

Marshall Miller has started mine design, sitewide civil design, and

waste rock stockpile planning for the Project to support permit

activities, Scoping Study update, and future Definitive Feasibility

Study. These studies are expected to continue throughout 2019 with a

planned completion by the end of 2019. Primero Group has commenced

design engineering to a PFS-level of accuracy and is scheduled to

complete a Scoping Study update in July 2019. The Scoping Study update

will integrate updated Mineral Resources, latest metallurgical testwork,

flowsheet optimization and updated costs.

Engineering work is proceeding at the PFS-level, but we are eliminating

the interim Pre-Feasibility Study from our time-line as drilling is

currently focused on resource and mine life expansion rather than the

infill drilling required to declare reserves. Following our current

drill campaign, we will complete additional infill drilling in advance

of an anticipated year-end DFS.

Permitting Activities Proceeding as Anticipated

The public comment period for the Company’s Section 404 Standard

Individual Permit application to the US Army Corps of Engineers (USACE)

concluded in February 2019. Piedmont has received the comments from

USACE and other regulatory agencies and will provide responses by May

31, 2019. Piedmont is also proceeding with state and local permit

applications. The Company will undertake a series of community

engagement meetings in the coming months and anticipates applying for a

North Carolina state mining permit and Gaston County conditional zoning

in Q3 2019.

The federal and state reviews are both proceeding as expected and the

Company remains confident that the permitting processes will be

successfully concluded by year-end 2019.

Strategic Discussions Initiated

Piedmont has been engaged in numerous preliminary off-take, financing

and strategic conversations over the past several months. Interested

parties are of a global nature, and include companies from the lithium,

mining, chemicals, battery, automotive and private equity sectors.

Piedmont expects to appoint financial and legal advisors in the coming

weeks to assist in the evaluation of strategic and financing options,

but we do not plan to report on such matters until there is more clarity

on the ultimate outcome.

About Piedmont Lithium

Piedmont Lithium Limited (ASX: PLL; Nasdaq: PLL) holds a 100% interest

in the Piedmont Lithium Project (“Project”) located within the

world-class Carolina Tin-Spodumene Belt (“TSB”) and along trend to the

Hallman Beam and Kings Mountain mines, historically providing most of

the western world’s lithium between the 1950s and the 1980s. The TSB has

been described as one of the largest lithium provinces in the world and

is located approximately 25 miles west of Charlotte, North Carolina. It

is a premier location for development of an integrated lithium business

based on its favorable geology, proven metallurgy and easy access to

infrastructure, power, R&D centers for lithium and battery storage,

major high-tech population centers and downstream lithium processing

facilities.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190408005847/en/

Keith D. Phillips

President & CEO

T: +1 973 809 0505

E:

kphillips@piedmontlithium.com

Anastasios (Taso) Arima

Executive Director

T: +1 347

899 1522

E: tarima@piedmontlithium.com