- Piedmont shipped approximately 14,000 dmt of spodumene concentrate in Q2’24; targets 96,500 dmt in H2’24

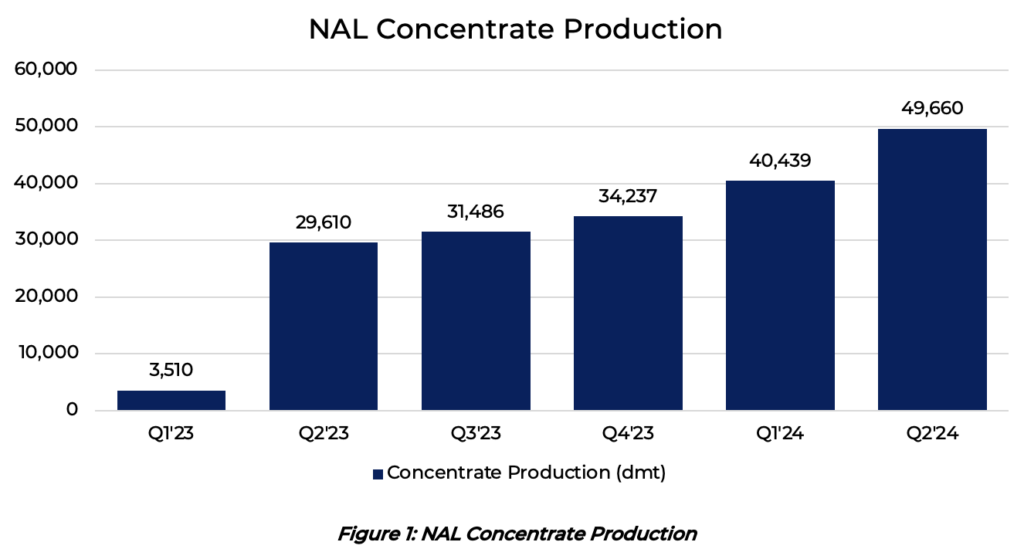

- Record quarterly production of 49,660 dmt, up 23% from Q1’24 as NAL nears H2’24 steady-state production target

- New quarterly highs achieved for lithium recovery at 68% and process plant utilization at 83%

- Crushed ore dome now operational and expected to further improve production levels and utilization rates

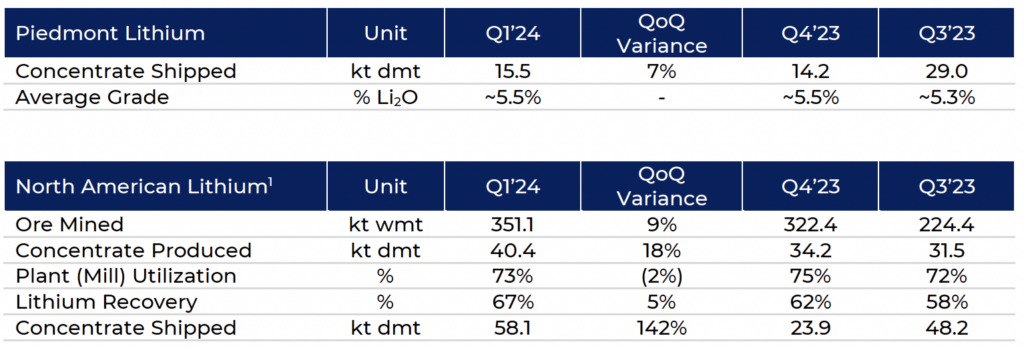

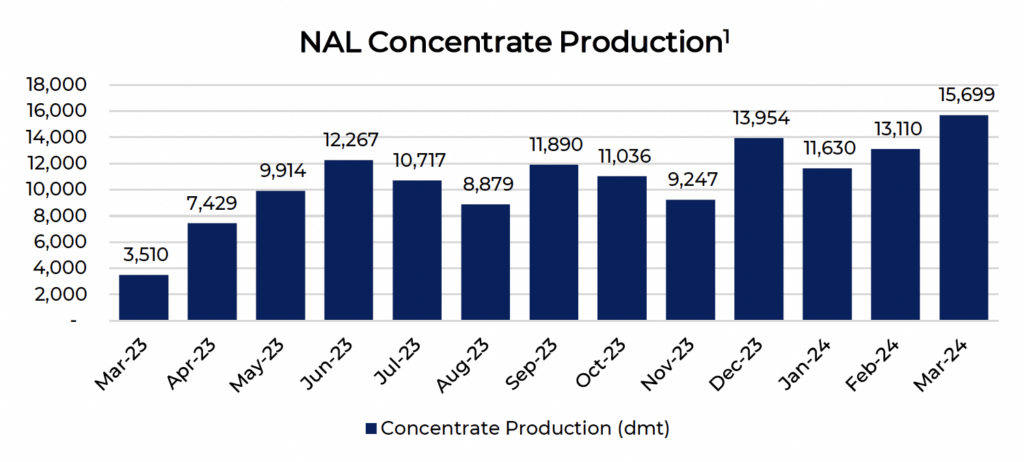

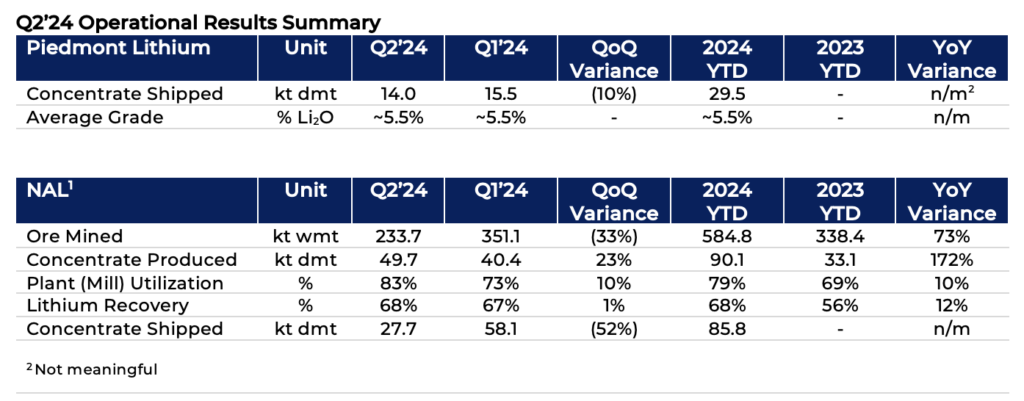

BELMONT, North Carolina, July 25, 2024 – Piedmont Lithium (“Piedmont” or the “Company”) (Nasdaq: PLL; ASX: PLL), a leading North American supplier of lithium products critical to the U.S. electric vehicle supply chain, today announced that it shipped approximately 14,000 dry metric tons (“dmt”) of spodumene concentrate in Q2’24 as its jointly owned North American Lithium (“NAL”) achieved new quarterly production and operations records.1 NAL, North America’s largest-producing spodumene mine, is jointly owned by Piedmont (25%) and Sayona Mining Limited (75%) (ASX: SYA). Per Piedmont’s NAL offtake agreement, the Company is targeting shipments of approximately 96,500 dmt of spodumene concentrate in H2’24 to support the full-year target of approximately 126,000 dmt, subject to shipping logistics, port and weather conditions, and customer requirements. Piedmont is prioritizing contract customer shipments as NAL nears the full run-rate production target of H2’24.

In Q2’24, NAL produced 49,660 dmt and shipped 27,729 dmt, of which approximately 14,000 dmt of spodumene concentrate were sold to Piedmont and shipped to customers. An additional Piedmont shipment totaling approximately 14,000 dmt was delayed from late Q2’24 to early Q3’24 due to port logistical issues.

NAL increased quarterly production by nearly 23% in Q2’24 compared to the prior quarter. Recovery rates improved to 68% during Q2’24, and mill utilization increased to 83%, up 10% from the previous quarter despite planned downtime in April to tie in the crushed ore dome. Notably, in June, mill utilization reached a record 91%, and operations set a single-day production record of 919 dmt of spodumene concentrate. Unit operating costs decreased by 2% quarter over quarter on a tons sold basis. Crushed ore dome commissioning was completed in Q2’24 and is expected to result in further improvements to production levels and utilization rates.

“As one of only a handful of active spodumene mines globally, NAL is a highly strategic asset with excellent operational performance as the ramp-up to steady-state production continues. With ongoing quarterly production records and the recent high-grade drill results of the 2023-2024 drill campaign, NAL has demonstrated significant progress and future potential,” said Keith Phillips, President and CEO of Piedmont Lithium. “As we enter the second half of the year, we look forward to increasing our shipments to contract customers. We welcome Mr. Lucas Dow as the newly appointed Managing Director and CEO of our partner, Sayona Mining, and we thank Mr. James Brown for his prior leadership.”

___________________

1 All references to information about or related to NAL are from the Quarterly Activities Report June 2024, filed with the ASX by Sayona Mining Limited on 25 July 2024.

About Piedmont Lithium

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest. Our projects include our Carolina Lithium and Tennessee Lithium projects in the United States and partnerships in Quebec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic Lithium (AIM: ALL; ASX: A11). We believe these geographically diversified operations help us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage. For more information, follow us on Twitter @PiedmontLithium and visit www.piedmontlithium.com.

Cautionary Note to U.S. Investors

Piedmont’s public disclosures are governed by the U.S. Exchange Act of 1934, including Regulation S-K 1300 thereunder, whereas NAL discloses estimates of “measured,” “indicated,” and “inferred” mineral resources as such terms are used in the JORC Code and Canada’s National Instrument 43-101. Although S-K 1300, the JORC Code, and NI 43-101 have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, they at times embody different approaches or definitions. Consequently, investors are cautioned that public disclosures by NAL prepared in accordance with the JORC Code or NI 43-101 may not be comparable to similar information made public by companies, including Piedmont, subject to S-K 1300 and the other reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

The statements in the link below were prepared by, and made by, NAL. The following disclosures are not statements of Piedmont and have not been independently verified by Piedmont. NAL is not subject to U.S. reporting requirements or obligations, and investors are cautioned not to put undue reliance on these statements. NAL’s original announcements can be found here.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development, construction, production, and ramp up activities or the timing of these activities, of Sayona Mining, Atlantic Lithium and Piedmont, including regarding operating cost improvements, regulatory approvals or permits or the timing thereof, project spend, timing of completion of capital projects and the effects of such projects, timing of planned deliveries and ability to improve productivity; current plans for Piedmont’s mineral and chemical processing projects; Piedmont’s potential acquisition of an ownership interest in Ewoyaa, including financing options, the timing of final investment decisions and project spend; strategy; market cycles; lithium prices; equity values; costs of new project developments; lithium shortages; lithium market recovery; certain Company approvals, permitting, partnering and debt funding discussions; a recently completed workforce reduction; expense management and possible or assumed future financial results or financial condition. Such forward-looking statements involve substantial and known and unknown risks, uncertainties, and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance or achievements and other factors to be materially different from the future timing of events, results, performance, or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont, Sayona Mining or Atlantic Lithium may be unable to commercially extract mineral deposits, (ii) that Piedmont’s, Sayona Mining’s or Atlantic Lithium’s properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), (iv) uncertainty about Piedmont’s ability to obtain required capital to execute its business plan, (v) Piedmont’s ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to our projects as well as the projects of our partners in Quebec and Ghana, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data and projections related to Sayona Mining or Atlantic Lithium, (xii) occurrences and outcomes of claims, litigation and regulatory actions, investigations and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations and our ability to obtain necessary permits, (xiv) our ability to deliver on our expense management efforts and other cost improvements expected upon completion of key capital projects as well as our future cash payments associated with these initiatives and potential future impairment charges, and (xv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”) and the Australian Securities Exchange, including Piedmont’s most recent filings with the SEC. The forward-looking statements, projections and estimates are given only as of the date of this press release and actual events, results, performance, and achievements could vary significantly from the forward-looking statements, projections and estimates presented in this press release. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections, and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

“We are excited to support Jocelyn and Lillyann in their academic journeys and STEM-related career objectives,” said Erin Sanders, Senior Vice President of Corporate Communications and Investor Relations of Piedmont Lithium and President of Power for Life. “Both Jocelyn and Lillyann should be proud of the achievements, leadership, and potential they have demonstrated thus far. We look forward to seeing these scholars further develop their skills and capabilities in college and beyond.”

“We are excited to support Jocelyn and Lillyann in their academic journeys and STEM-related career objectives,” said Erin Sanders, Senior Vice President of Corporate Communications and Investor Relations of Piedmont Lithium and President of Power for Life. “Both Jocelyn and Lillyann should be proud of the achievements, leadership, and potential they have demonstrated thus far. We look forward to seeing these scholars further develop their skills and capabilities in college and beyond.” Jocelyn Doorley

Jocelyn Doorley Lillyann Chambers

Lillyann Chambers