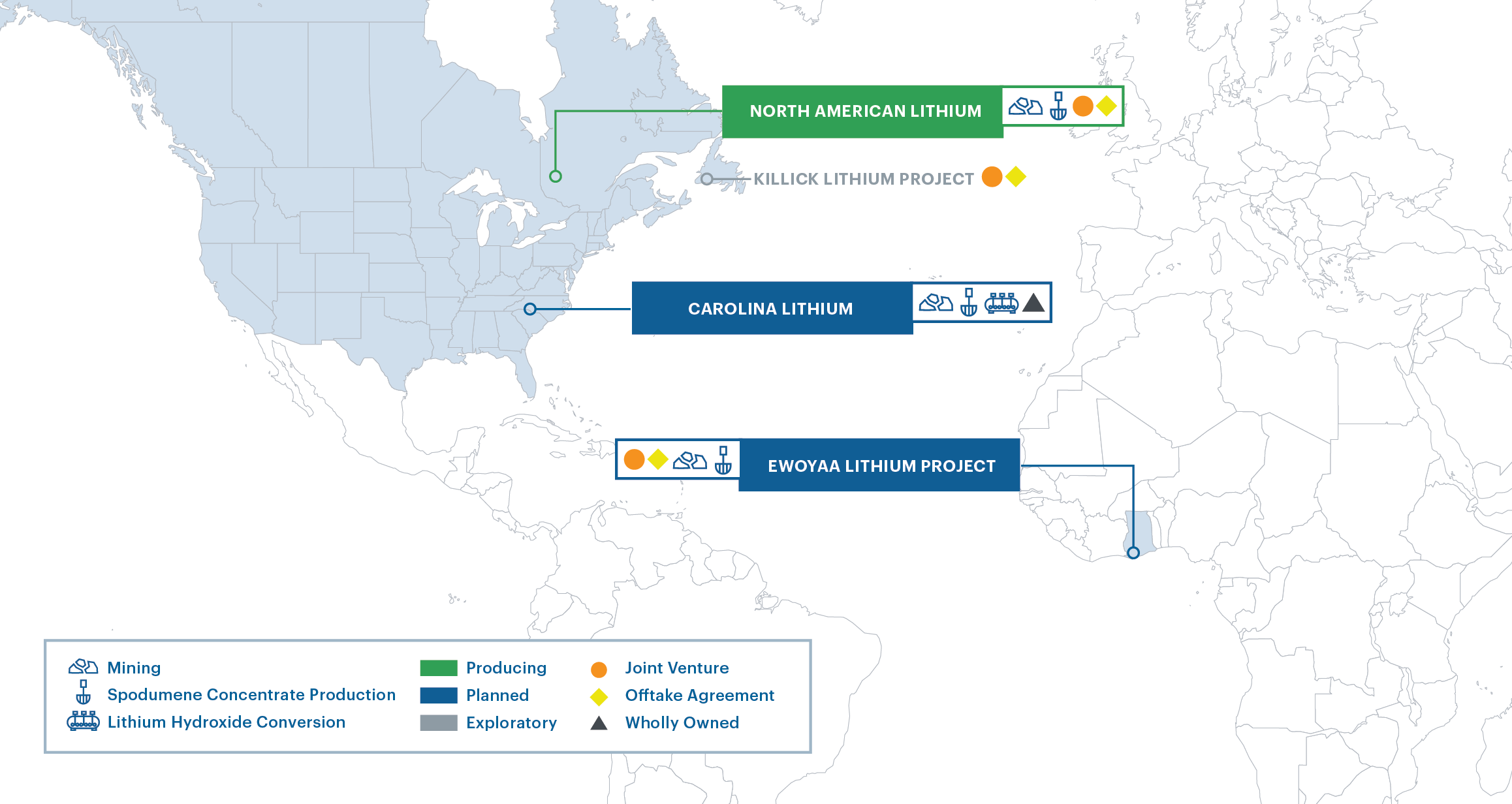

PROJECTS

A GLOBAL PORTFOLIO.

MAKING A DIFFERENCE FOR AMERICA.

The roots of Piedmont Lithium date back to the early 2000s, when geologist Lamont Leatherman explored an area near his childhood home in North Carolina in what is now considered the heart of America’s Battery Belt. His discovery of lithium-rich pegmatite rocks within the Carolina Tin-Spodumene Belt led to the founding of Piedmont Lithium and a better understanding of the potential of our proposed Carolina Lithium project.

Since 2016, Piedmont has focused on developing a hard rock portfolio of assets to significantly increase the supply of American-made lithium hydroxide and bolster U.S. energy security. We believe spodumene concentrate production represents the lowest-risk and most commercially scalable raw material resource to meet the growing demand to increase domestic lithium hydroxide production capacity.

Our foundational Carolina Lithium project is the center of our U.S. development strategy as a multi-phase, fully integrated mining, spodumene concentrate production, and lithium hydroxide conversion campus in Gaston County, North Carolina. The project plans include two lithium hydroxide conversion trains to be constructed in phases for a total production capacity of 60,000 metric tons annually.

Our portfolio also includes spodumene assets in Quebec and Ghana. Our jointly owned North American Lithium project in Quebec is North America’s largest-producing lithium mine and one of the world’s few active hard rock spodumene operations supplying the market today. Our joint venture Ewoyaa Lithium Project is expected to be a relatively low-cost, large operation in the Cape Coast of Africa that will produce additional spodumene concentrate.

Through this global portfolio of integrated projects, Piedmont is positioned to support the race to develop a robust domestic battery supply chain as a key contributor to the U.S. electrification revolution and American energy independence.

The Crucial Need for U.S. Lithium Hydroxide Capacity.

The developing global electrification industry is experiencing considerable growth, and the increasing demand for lithium-ion batteries is expected to continue through the next decade and beyond. As the adoption of electric vehicles rises, battery pack sizes are growing, requiring more lithium to power in-car applications and longer driving ranges. Energy storage systems are also accelerating the demand for lithium to support the growing need for decarbonization and uninterrupted power supplies.

By 2030, the demand for lithium is expected to surge by 172% from 2024 levels.1 Meanwhile, America is falling woefully behind in the race to build domestic production capacity, relying almost entirely on lithium imports to meet current battery demands.

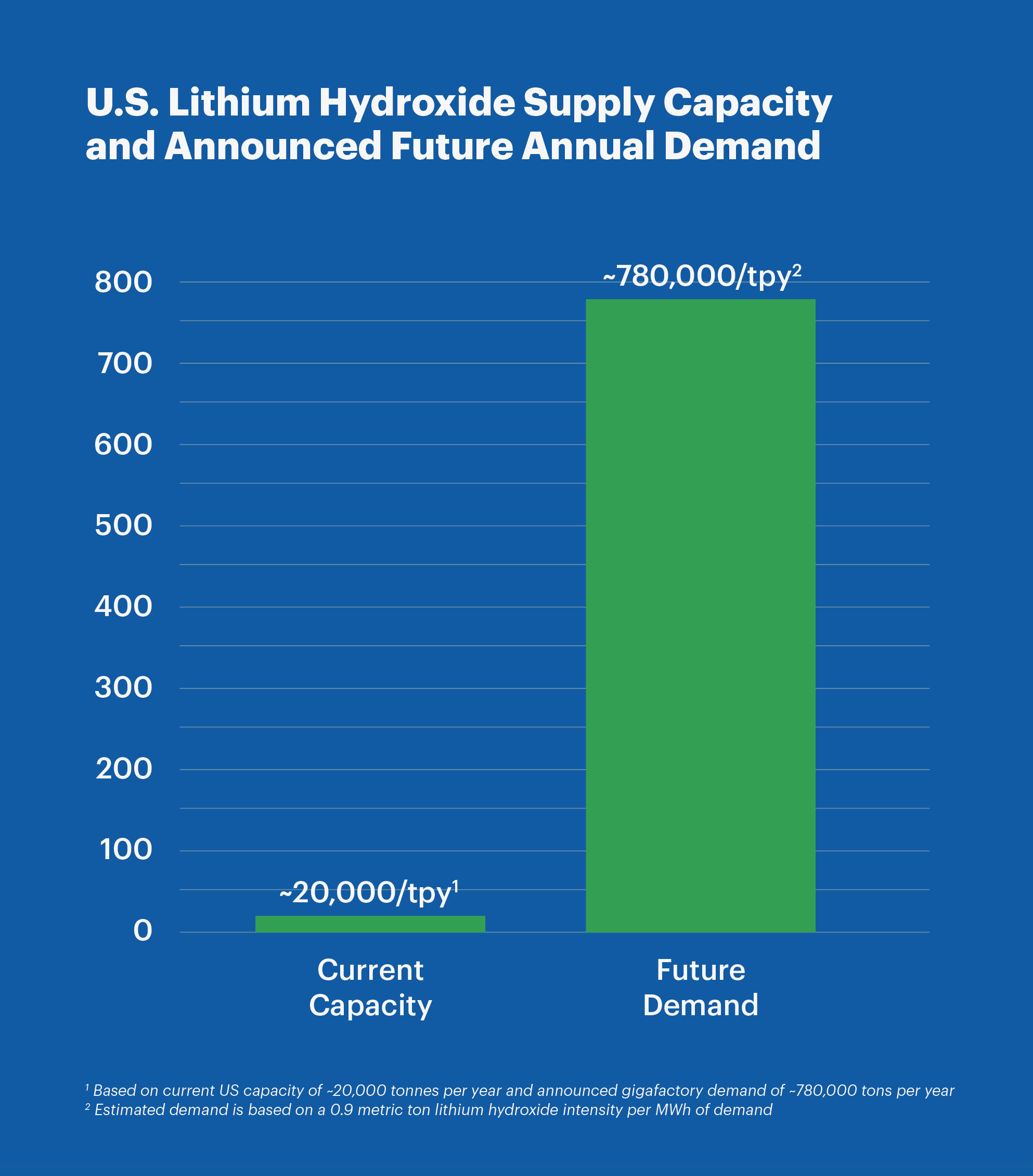

Today, China manufactures approximately 72%1 of the world’s lithium hydroxide supply, while the United States produces only 5%.1 However, more than $80 billion2 in commitments have been announced to build or expand U.S. battery manufacturing facilities. These projects, once completed, are projected to require approximately 780,000 metric tons of lithium hydroxide annually in the future – more than 35 times the current domestic production capacity of 20,000 metric tons per year.

In short, the U.S. does not produce nearly enough lithium hydroxide to support the projected domestic demand.

We believe that dramatically increasing U.S. lithium hydroxide production to reduce our reliance on foreign nations is not only crucial for American energy independence but also for American manufacturing and American jobs.

1 Benchmark Mineral Intelligence

2 Based on published company announcements as of June 2024