Piedmont Increases Mineral Resources with Completion of Phase 5 Infill Drilling

Inaugural Mineral Resources reported under new U.S. S-K 1300 Standards

- Carolina Lithium Project total Mineral Resources increase to 44.2 Mt @ 1.08% Li2O

- Indicated Mineral Resources increased 101% to 28.2 Mt @ 1.11% Li2O for the Project

- DFS completion for the integrated 30,000 t/y LiOH Carolina Lithium Project expected within Q4 2021

BELMONT, NC – Piedmont Lithium Inc. (Nasdaq: PLL) (“Piedmont” or “Company”) is pleased to announce an updated global Mineral Resource estimate (“MRE”) (Table 1) for the Company’s flagship Carolina Lithium Project in North Carolina, USA. The MRE includes updates for lithium and industrial mineral products. The total MRE for the project is 44.2 Mt @ 1.08% Li2O, with 64% of the total MRE classified in the Indicated category. The Mineral Resource estimate reported in accordance with the U.S. Securities and Exchange Commission S-K 1300 standards and the Australasian JORC Code (2012 Edition).

Table 1: Carolina Lithium Project – Summary of Mineral Resources Estimate at October 20, 2021 Based on Long-Term Pricing of US$ 15,239/t LiOH*H2O | |||||||

Resource Category | Tonnes (Mt) | Grade (Li2O%) | Li2O (t) | LCE (t) | LiOH·H2O (t) | Cut-Off Grade (% Li2O) | Metallurgical Recovery (%)1 |

Indicated | 28.2 | 1.11 | 313,000 | 774,000 | 879,000 | 0.4 | 71.2 |

Inferred | 15.9 | 1.02 | 162,000 | 401,000 | 455,000 | ||

Total | 44.2 | 1.08 | 475,000 | 1,175,000 | 1,334,000 |

Note 1 – Overall metallurgical recovery from spodumene ore to lithium hydroxide monohydrate

Keith D. Phillips, President and Chief Executive Officer, commented: “We are very pleased to have concluded our Phase 5 drill campaign and to further expand our world-class resource base. Carolina Lithium has one of the largest spodumene resources in North America, and the only one located in the United States. The increase in ‘Indicated’ resources of over 100% relative to resources previously reported under Australian standards, will underpin the definitive feasibility study for Carolina Lithium that we plan to publish later in 2021. The DFS will be another important step along the path to building America’s leading lithium business to support and enable the rapidly-growing electric vehicle supply chain in the United States.”

The Company intends to file an inaugural Technical Report Summary in accordance with the United States Securities and Exchange Commission Regulation S-K 1300 Modernization of Property Disclosures requirements in the Company’s next Quarterly Report on Form 10-Q.

The updated Mineral Resources will be incorporated into the upcoming Definitive Feasibility Study of the Carolina Lithium Project, which the Company expects to complete within Q4 2021.

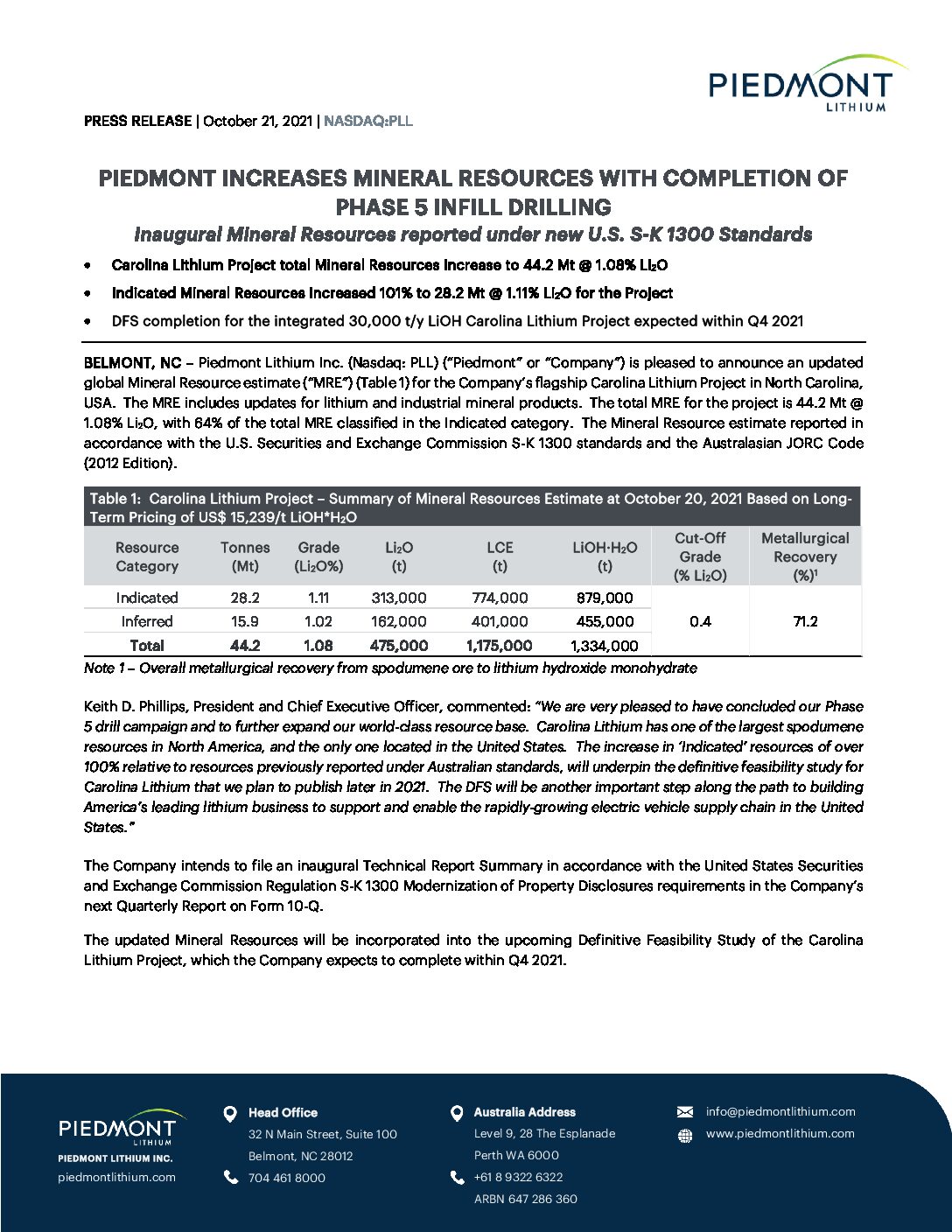

Figure 1 – Piedmont Lithium’s Carolina Lithium Project Regional Map

Technical Discussion

Overview

Piedmont holds a 100% interest in the Carolina Lithium Project located within the Tin-Spodumene Belt and along trend to the Hallman Beam and Kings Mountain mines, which historically provided most of the western world’s lithium between the 1950s and the 1980s.

The Project is located in a rural area of Gaston County, North Carolina, USA approximately 40 km northwest of the city of Charlotte. The Project is located on the Bessemer City, Lincolnton West, and Lincolnton East United States Geological Survey (USGS) Quadrangles. The coordinate system and datum for the modeling is UTM-17N, NAD-83. The Property is centered at approximately 35°23’20”N 81°17”20”W and is comprised of approximately 3,245 total acres, of which 1,526 acres are claims on private property through option or deferred purchase agreements, 113 acres are under a long-term mineral leased agreement, 79 acres are under lease to own agreements, and 1,527 acres are owned by Piedmont. For the properties hosting the MREs in this report, Piedmont controls 100% of the surface and mineral rights per one or more agreement scenarios.

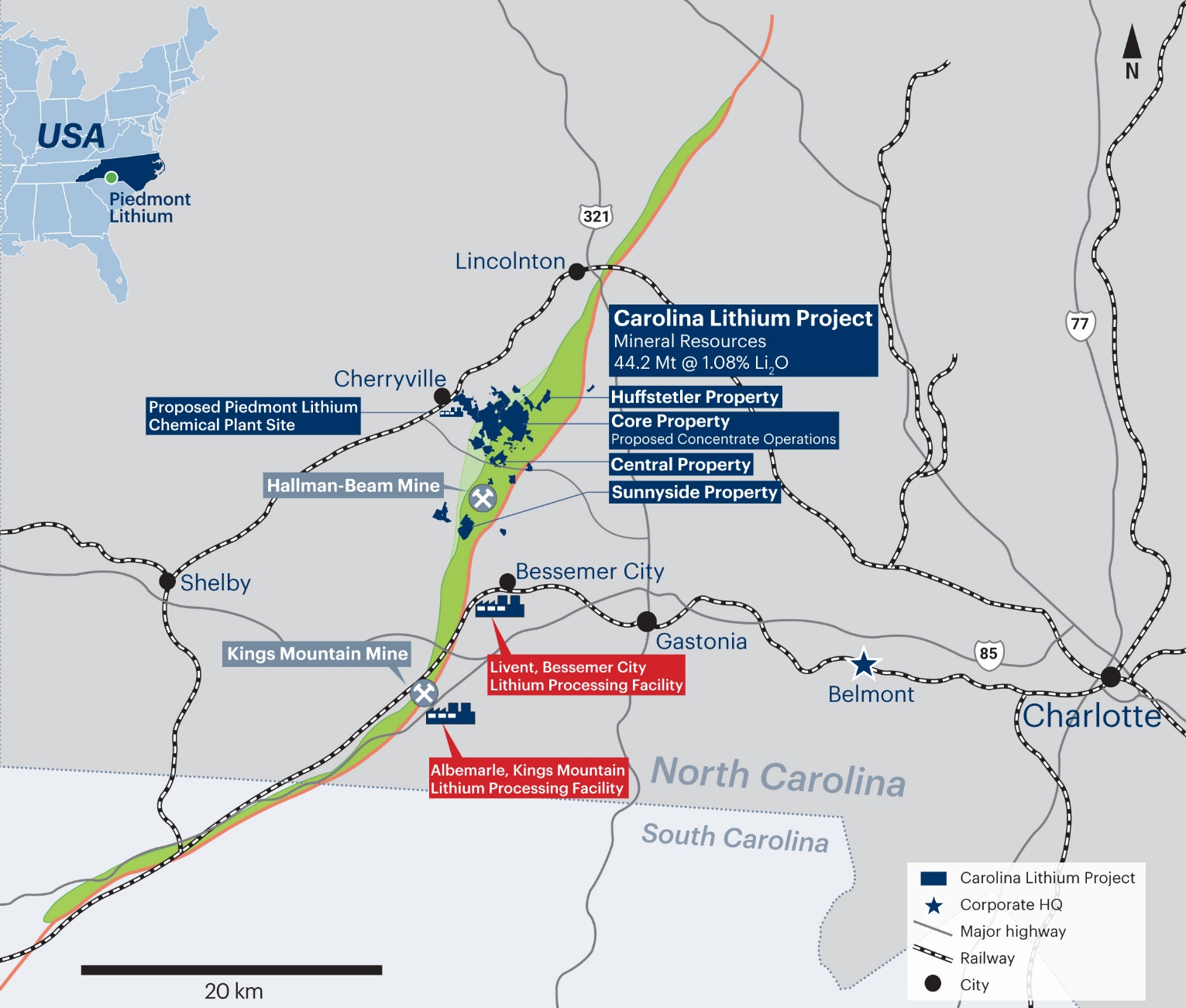

Global Mineral Resources

The Global Mineral Resource estimate, reported in Table 1, includes an update of lithium and by-product Mineral Resources for the Core property and the Central and Huffstetler Mineral Resources previously reported under Australian standards on 9 June 2021. The details of the three MREs are summarized in Table 2. Central and Huffstetler properties are within one mile of the Core property along the trend of the Carolina Tin-Spodumene Belt (Figure 2). The mineral percentages for the MRE were derived from a normative mineralogical calculation using XRF major oxide analysis for spodumene bearing pegmatites within the current lithium Mineral Resource.

The Qualified Person concludes that sufficient data have been obtained through various exploration, sampling, and metallurgical testwork programs to support the geological interpretation of lithium-bearing pegmatite deposits on the Property. The data are of sufficient quantity and reliability to reasonably support the MRE. The MRE has been classified as Indicated and Inferred based on the guidelines specified by S-K 1300 and the JORC Code (2012 Edition). Classification is based upon an assessment of geological understanding of the deposit, geological and grade continuity, drill hole spacing, quality control results, search and interpolation parameters, and an analysis of available density information. Modeled Mineral Resources for each deposit appear to be of sufficient grade, quality, quantity, and coherence to have reasonable prospects for eventual economic extraction by open pit mining methods.

The Mineral Resource is based on an overall metallurgical recovery from spodumene to lithium hydroxide of 71.20%.

The updated lithium and by-product Mineral Resources will support the completion of a Definitive Feasibility Study with an estimated completion date within Q4 2021.

Table 2: Carolina Lithium Project – Summary of By-Product Quartz, Feldspar, and Mica Mineral Resources Estimates Based on Long-Term Pricing of US$ 15,239/t LiOH*H2O, Average By-Product Pricing of US$ 79.50/t | ||||||||||

Li2O | Quartz | Feldspar | Mica | |||||||

Cut-Off Grade (Li2O %) | 0.4 | 0.4 | 0.4 | 0.4 | ||||||

Metallurgical Recovery (%) | 71.21 | 50.8 | 51.1 | 35.5 | ||||||

Category | Deposit | Tonnes (Mt) | Grade | Tonnes (Mt) | Grade | Tonnes (Mt) | Grade | Tonnes (Mt) | Grade | Tonnes (Mt) |

Indicated | Core | 25.75 | 1.10 | 0.282 | 29.59 | 7.62 | 45.06 | 11.60 | 4.29 | 1.10 |

Central | 2.47 | 1.30 | 0.031 | 28.79 | 0.71 | 45.16 | 1.12 | 3.24 | 0.08 | |

Huffstetler | 0.00 | 0.00 | 0.000 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

Total | 28.22 | 1.11 | 0.313 | 29.52 | 8.33 | 45.07 | 12.72 | 4.20 | 1.18 | |

Inferred | Core | 10.93 | 1.02 | 0.111 | 29.13 | 3.18 | 45.52 | 4.97 | 4.18 | 0.46 |

Central | 2.69 | 1.10 | 0.030 | 29.99 | 0.81 | 43.88 | 1.18 | 4.08 | 0.11 | |

Huffstetler | 2.31 | 0.91 | 0.021 | 28.82 | 0.67 | 48.60 | 1.12 | 3.24 | 0.08 | |

Total | 15.93 | 1.02 | 0.162 | 29.22 | 4.66 | 45.67 | 7.28 | 4.03 | 0.64 | |

MRE Total | 44.15 | 1.08 | 0.475 | 29.42 | 12.99 | 45.30 | 20.00 | 4.12 | 1.82 |

Note 1 – Overall metallurgical recovery from spodumene ore to lithium hydroxide monohydrate

Figure 2 – Piedmont Carolina Lithium Project Mineral Resource location map showing updated MRE and resource constraining shells.

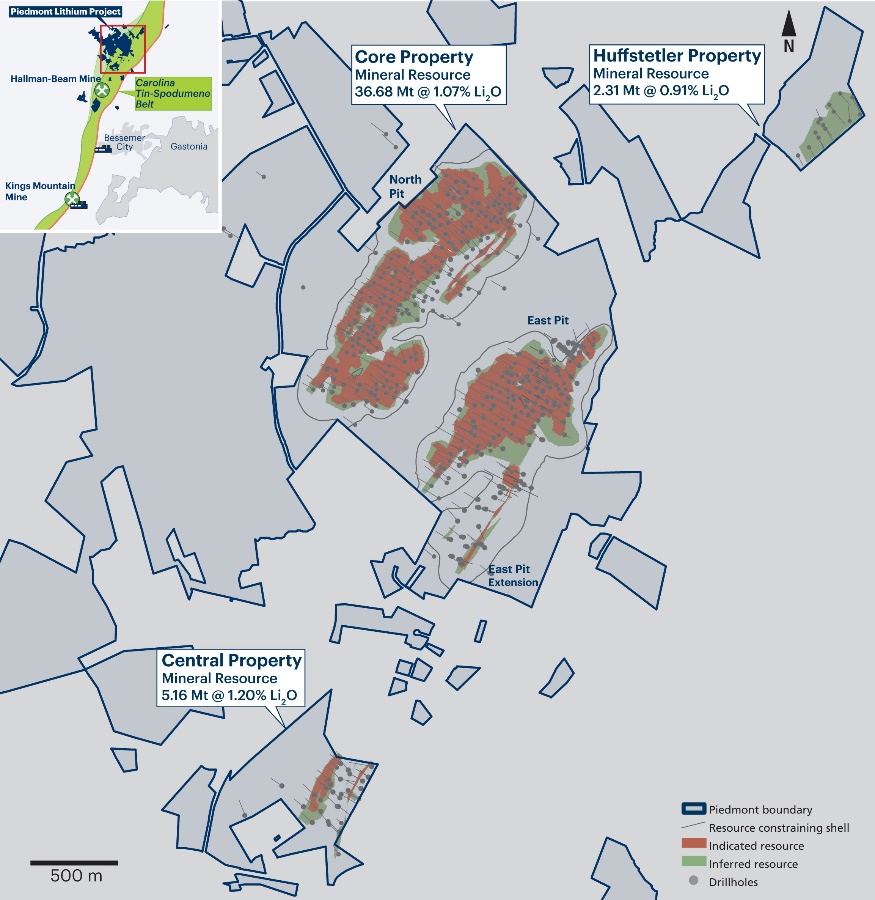

Core Property

This MRE update incorporates the results of 127 diamond core holes totaling 18,567 meters (Appendix 1) drilled during the recently completed Phase 5 drill program. The update has increased the Core property MRE by 16%, from the 31.68 Mt @ 1.07% Li2O, reported in April 2021, to 36.68 Mt @ 1.07% Li2O. The increase in MRE size has come from several areas with the most significant being in the north pit area where numerous laterally extensive pegmatite sills and inclined sheets have been discovered. Sills and inclined sheets are typically stacked with cumulative true thicknesses of 10 to 20 meters. Individual sheets have been traced for 500 meters along strike and 300 meters down dip and range up to 12 meters true thickness.

A primary objective of the Phase 5 drilling was to complete infill drilling at the Core property. Results from this drilling have increased the Mineral Resources in the Indicated category by 101% compared with the Mineral Resources previously reported on June 25, 2019. Indicated resources account for 70% of the updated Core Property MRE. Furthermore, 92% of the resource is within 150 m of the topography surface.

Figure 3 – Drillhole location map for the Core property

Summary of Resource Estimate and Reporting Criteria

The Mineral Resource estimate, representing in-situ lithium-bearing pegmatites, are reported in accordance with (SEC) Regulation S-K 1300 and are therefore suitable for public release. Lithium Mineral Resources include tonnage estimates for Li2O and lithium hydroxide (LiOH·H2O) whereby one tonne of Li2O is equivalent to 2.81 tonnes lithium hydroxide.

The resource has additionally been prepared in compliance with S-K 1300, JORC Code 2012 Edition and the ASX Listing Rules.

The following is a summary of the pertinent information used in the MRE.

Geology and Geological Interpretation

Regionally, the Carolina Tin-Spodumene belt extends for 40 kilometers along the litho tectonic boundary between the Inner Piedmont and Kings Mountain belts. The mineralized pegmatites are thought to be concurrent and cross-cutting dike swarms extending from the Cherryville granite, as the dikes progressed further from their sources, they became increasingly enriched in incompatible elements such as lithium (Li) and tin (Sn). The dikes are considered to be unzoned.

On the property scale, spodumene pegmatites are hosted in a fine to medium grained, weakly to moderately foliated amphibolites and metasediments. The spodumene pegmatites range from fine grained (aplite) to very coarse-grained pegmatite with primary mineralogy consisting of spodumene, quartz, plagioclase, potassium-feldspar and muscovite.

Drilling and Sampling Techniques

These resources are an update to the previous Mineral Resource estimates reported in June 2021 in which the resource was informed by 415 drillholes at the Core property. The current resource estimate is now informed by a total of 542 drillholes at the Core property. Table 4 shows the allocation of drillholes per property.

Table 4: Drill Hole Summary for the Mineral Resource Estimate Update | |||

|---|---|---|---|

Property | Drill Type | Number of Holes | Number of Holes with XRF data |

Core | Diamond and Rotary Sonic Core | 542 | 303 |

Central | Diamond Core | 36 | 22 |

Huffstetler | Diamond Core | 14 | 14 |

All diamond drill holes were collared with HQ and were transitioned to NQ once non-weathered and unoxidized bedrock was encountered. Drill core was recovered from surface.

Oriented core was collected on select drill holes using the REFLEX ACT III tool by a qualified geologist at the drill rig. This data was highly beneficial in the interpretation of the pegmatite dikes.

The drill spacing is approximately 40 to 80 meters along strike and down dip. This spacing is sufficient to establish continuity in geology and grade for this pegmatite system.

Drill collars were located with the differential global positioning system (DGPS) with the Trimble Geo 7 unit which resulted in accuracies <1 meter. All coordinates were collected in State Plane and re-projected to Nad83 zone 17 in which they are reported.

Down hole surveying was performed on each hole using a REFLEX EZ-Trac multi-shot instrument. Readings were taken approx. every 15 meters (50 feet) and recorded depth, azimuth, and inclination. All holes were geologically and geotechnically logged. All holes were photographed prior to sampling. Sampled zones were subsequently photographed a second time after the samples had been marked.

The core was cut in half with a diamond saw with one half submitted as the sample and the other half retained for reference. Standard sample intervals were a minimum of 0.35 m and a maximum of 1.5 m for HQ or NQ drill core, taking into account lithological boundaries (i.e. sample to, and not across, major contacts). A CRM or coarse blank was included at the rate of one for every 20 drill core samples (i.e. 5%). Sampling precision is monitored by selecting a sample interval likely to be mineralized and splitting the sample into two ¼ core duplicate samples over the same sample interval. These samples are consecutively numbered after the primary sample and recorded in the sample database as “field duplicates” and the primary sample number recorded. Field duplicates were collected at the rate of 1 in 20 samples when sampling mineralized drill core intervals.

Sample Analysis Method

Normative mineralogy was calculated from total fusion X-ray fluorescence (XRF) major element data using a least squares method (MINSQ – Herrmann, W. and Berry, R.F., 2002, Geochemistry: Exploration, Environment, Analysis, volume 2, pp. 361-368). The normative calculations were validated against and corrected where necessary using X-ray diffraction (XRD) Rietveld semi-quantitative mineralogical data from 38 sample pulps selected to represent a range of chemical compositions and mineralogy, as well as 3 QEMSCAN analyses of composite samples prepared for metallurgical test work.

Resource Estimation Methodology

Lithological and structural features were defined based upon geological knowledge of the deposit derived from drill core logs and geological observations on surface. Wireframe models of 92 pegmatite bodies were created in Micromine® by joining polygon interpretations made on cross sections and level plans spaced at 40 meters. Weathering profiles representing the base of saprolite and overburden were modelled based upon drill hole geological logging. Modelling utilized a topographic digital terrain model (“DTM”) that incorporates LiDAR and photogrammetry data with high accuracy RTN-GPS survey control. The LiDAR data has an accuracy class of +/- 0.1 meters.

Rotated block models were constructed in Micromine® that encompass all modelled dikes using parent cell sizes of 6 m (E) by 12 to 18 m (N) by 6 to 18m (Z). The drill hole files were flagged by the pegmatite and weathering domains they intersected. Statistical analysis of the domained data was undertaken in Supervisor®. Samples were regularized to 1 meter composite lengths. Regularized weight percent mineral grades within the pegmatite model were analyzed to confirm the suitability of the Ordinary Kriging method also used for the lithium Mineral Resource estimate. For each modelled pegmatite, regularized compositional grades for spodumene, quartz, albite, K-spar and muscovite were interpolated into the corresponding pegmatite block model along with grades for biotite and other gangue minerals. Albite and K-spar grade estimates are summed to generate a compositional grade estimate for feldspar by-product.

Block grade interpolation was validated by means of swath plots, comparison of sample and block model mineral grade averages and correlation coefficients, and by overlapping mineral grade distribution charts for sample and block model data. Cross sections of the block model with drill hole data superimposed were also reviewed.

Classification Criteria

Resource classification parameters are based on the validity and robustness of input data and the estimator’s judgment with respect to the proximity of resource blocks to sample locations and confidence with respect to the geological continuity of the pegmatite interpretations and grade estimates.

All blocks captured in pegmatite dike interpretation wireframes below the topography surface are classified as Inferred. Indicated classification boundaries define regions of blocks that, overall, meet the following criteria: Within major pegmatite dikes that are informed by at least two drill holes within a range of approximately 25 meters to the nearest drill hole in the along strike and down dip directions.

No Measured category resources are estimated.

Cut-Off Grade, Mining and Metallurgical Methods and Parameters

The Mineral Resource Estimate is reported at a 0.4% Li2O cut-off grade, in line with cut off grades utilized at comparable deposits. The economic extraction of by-product minerals is contingent on the economic extraction of lithium mineral resources at the Project. Accordingly, the by-product Mineral Resource Estimate is also reported at a 0.4% Li2O cut-off grade.

The depth, geometry, and grade of pegmatites at the property make them amenable to exploitation by open cut mining methods. The Core resource model is constrained by a conceptual pit shell derived from a Whittle optimization using estimated block value and mining parameters appropriate for determining reasonable prospects of economic extraction. These include: maximum pit slope of 50° and strip ratio of 12, mining cost of US$2.90/t, spodumene concentration cost of US$25/t, processing cost of US$2,616/t LiOH·H2O, commodity price equivalent to US$15,239/t LiOH·H2O and with appropriate recovery and dilution factors. Material falling outside of this shell is considered to not meet reasonable prospects for eventual economic extraction.

Conceptual shells for Central and Huffstetler resource models, developed using the above parameters, extended to the base of the resource models and beyond the modelled strike extent of the resource model where the deposits are open. Accordingly, the entire Central and Huffstetler resource models are considered to have reasonable prospects of eventual economic extraction.

Reasonable prospects for metallurgical recovery of spodumene and by-product minerals are supported by the results of the variability and composite sample test work undertaken at SGS laboratories in Lakefield, Ontario and previously announced on May 13, 2020. Bulk samples of the quartz, feldspar and mica co-products from the Project have been evaluated for attributes such as product size distribution, chemical composition, purity, and color. Test work results demonstrate that by-products have specifications that are marketable to prospective regional customers and strategic partners in the solar glass, engineered quartz, ceramic tile, and other industrial minerals markets.

Piedmont plans to release a Definitive Feasibility Study for the project within Q4 2021. Piedmont continues to evaluate newly acquired properties within the Carolina Tin Spodumene Belt for lithium mineralization.

The Qualified Person recommends the following actions are completed to support the ongoing Mineral Resource development effort at the Carolina Lithium Project:

- Investigate shallow portions of Core Property deposits deemed amenable to early-stage mining through infill drilling and appropriate surface methods, at 20 m to 40 m spacings. An understanding of the short-range variability of mineralization, pegmatite dike orientation, and weathering should be developed, and Measured resource classification criteria established.

- Model the extent of major metavolcanic and metasedimentary host rock units to support mine planning at the Core property. Models will improve bulk density estimation and support environmental and geotechnical characterization of waste rock.

- Conduct infill drilling to increase data density and support the upgrading of Mineral Resources from Inferred to Indicated throughout the Project.

- Undertake a study to identify new exploration targets and prioritize step-out drill targets that expand defined resource pegmatites.

- To support exploration targeting across its properties, and to direct future property acquisitions, Piedmont should continue to synthesize a mineral system model for spodumene bearing pegmatites along the TSB.

About Piedmont Lithium

Piedmont Lithium (Nasdaq:PLL; ASX:PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. The centerpiece of our operations, Carolina Lithium, is located in the renowned Carolina Tin Spodumene Belt of North Carolina. Combining our U.S. assets with equally strategic and in-demand mineral resources, and production assets in Quebec and Ghana, positions us to be one of the largest, lowest cost, most sustainable producers of battery-grade lithium hydroxide in the world. We will also be the most strategically located to best serve the fast-growing North American electric vehicle supply chain. The unique geology, geography and proximity of our resources, production operations and customer base, will allow us to deliver valuable continuity of supply of a high-quality, sustainably produced lithium hydroxide from spodumene concentrate, preferred by most EV manufacturers. Our diversified operations will enable us to play a pivotal role in supporting America’s move toward decarbonization and the electrification of transportation and energy storage. For more information, visit www.piedmontlithium.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development and construction activities; current plans for Piedmont’s mineral and chemical processing projects; strategy; and expectations regarding permitting. Such forward-looking statements involve substantial and known and unknown risks, uncertainties and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance or achievements and other factors to be materially different from the future timing of events, results, performance or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont will be unable to commercially extract mineral deposits, (ii) that Piedmont’s properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), (iv) uncertainty about Piedmont’s ability to obtain required capital to execute its business plan, (v) Piedmont’s ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data and projections related to Sayona Quebec and IronRidge Resources, (xii) occurrences and outcomes of claims, litigation and regulatory actions, investigations and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations and our ability to obtain necessary permits, and (xiv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”) and the Australian Securities Exchange, including Piedmont’s most recent filings with the SEC. The forward-looking statements, projections and estimates are given only as of the date of this presentation and actual events, results, performance and achievements could vary significantly from the forward-looking statements, projections and estimates presented in this presentation. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

The information contained herein by Piedmont has been prepared in accordance with the requirements of the securities laws in effect in the United States and Australia. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are used herein as defined by the U.S. Securities and Exchange Commission (“SEC”) in Regulation S-K, Item 1300 (“S-K 1300”) and as defined in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”).

Qualified Persons Statement

The information in this announcement that relates to Exploration Results is based on, and fairly represents, information compiled or reviewed by Mr. Lamont Leatherman, a Qualified Person who is a Registered Member of the ‘Society for Mining, Metallurgy and Exploration’, a ‘Recognized Professional Organization’ (RPO). Mr. Leatherman is an employee of the Company. Mr. Leatherman has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in S-K 1300 and as a Competent Person as defined in the JORC Code. Mr. Leatherman consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Exploration Targets and Mineral Resources is based on, and fairly represents, information compiled or reviewed by Mr. Leon McGarry, a Qualified Person who is a Professional Geoscientist (P.Geo.) and registered member of ‘Professional Geoscientists Ontario’ (PGO no. 2348), a ‘Recognized Professional Organization’ (RPO). Mr. McGarry is a Principal Resource Geologist and full-time employee at McGarry Geoconsulting Corp. Mr. McGarry has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Qualified Person as defined in S-K 1300 and the JORC Code. Mr. McGarry consents to the inclusion in this report of the results of the matters based on his information in the form and context in which it appears.

Steve Keim is a licensed Professional Engineer (PE) and Registered Member of the Society of Mining Engineers (SME), Golden, Colorado, USA. Kevin Andrews is a Certified Professional Geologist (CPG) under requirements of the American Institute of Professional Geologists (AIPG) and a Registered Member of SME. SME and AIPG are Recognized Professional Organizations (RPO). Both Mr. Keim and Mr. Andrews are full-time employees of MM&A and are recognized as qualified individuals to review the resource estimate and associated data.

For further information, contact:

SVP, Corporate Communications & Investor Relations

T: +1 704 575 2549

E: esanders@piedmontlithium.com