Creates a Leading North American Lithium Producer and Developer

- Piedmont and Sayona to combine in all-stock merger with ownership split of approximately 50% / 50% on a fully diluted basis immediately post-merger and prior to the conditional equity raising

- Creating a leading North American hard rock lithium producer with geographically advantaged spodumene resources of global scale

- Simplified corporate structure aligns North American Lithium (“NAL”) offtake economics, and removes contractual complexities

- Unified ownership of NAL unlocks the potential for a significant brownfield expansion

- Combined scale provides strategic flexibility to combine and optimize downstream strategies

- Material corporate, logistics, marketing, and procurement synergies

- Significantly strengthened balance sheet with two stage equity financing, with post-merger raise led by cornerstone subscription from Resource Capital Fund VIII L.P. (“RCF VIII”), associated with Resource Capital Funds (“RCF”), a critical minerals and mining-focused global investment firm

- MergeCo will endeavor to complete an additional equity raise for eligible retail shareholders post-closing

BELMONT, North Carolina, November 18, 2024 – Piedmont Lithium Inc. (“Piedmont” or the “Company”) (NASDAQ: PLL; ASX: PLL), a leading North American supplier of lithium products critical to the U.S. electric vehicle supply chain, and Sayona Mining Limited (“Sayona”) (ASX: SYA) announce the signing of a definitive agreement (the “Merger Agreement”) to combine the two companies to create a leading lithium business, resulting in Sayona being the ultimate parent entity (“MergeCo”) (the “Transaction”).

The Transaction will result in an approximate 50% / 50% equity holding of shareholders of Piedmont and Sayona (on a fully diluted basis) in MergeCo immediately following the closing of the Transaction. Piedmont will be undertaking a proposed capital raise of ~US$27 million. Sayona is undertaking a capital raise of A$40 million (~US$27 million). Upon closing of the Transaction, Sayona will also undertake a conditional placement (“Conditional Placement”) for A$69 million in MergeCo to Resource Capital Fund VIII L.P. (“RCF VIII”). The placement is subject to completion of the Transaction and requisite Sayona shareholder approval and other conditions. The equity raisings, aggregating to approximately US$99million, plan to ensure MergeCo is well positioned to accelerate growth within its enlarged portfolio.

Completion of the Transaction is subject to shareholder approval for both companies and is expected to close in the first half of CY2025. A proxy statement containing important information about the Merger will be dispatched to Piedmont shareholders and filed with the U.S. Securities and Exchange Commission prior to a Piedmont shareholder meeting to seek approval of the Transaction. An Extraordinary General Meeting (“EGM NoM”) of Sayona shareholders is expected to be held in the first half of calendar year 2025 to seek, amongst other things, approval of the Transaction.

Piedmont Lithium’s President and Chief Executive Officer, Keith Phillips, said: “This merger combines two complementary businesses and will create a larger and stronger company. MergeCo will be North America’s largest lithium producer and will have an attractive growth profile with three DFS-stage development projects and an exciting near-term brownfield expansion opportunity at NAL. The merger financing, corner-stoned by leading mining private equity group RCF, will enable us to weather the current industry downturn while making intelligent investments in our growth projects to be positioned for the recovery in lithium markets that we expect in the medium-term. MergeCo will be domiciled in Australia, but will maintain a listing on Nasdaq and a strong commitment to our Carolina Lithium project and our U.S. headquarters in Belmont, North Carolina.”

Sayona’s Chief Executive Officer and Managing Director, Lucas Dow, said: “This merger marks a transformative step for Sayona and Piedmont, creating a leading North American lithium producer with the scale and capabilities to meet the growing demand for lithium products. We believe our combined resources and expertise will enable us to deliver significant value to our shareholders and stakeholders. We are excited about the opportunities this merger presents to accelerate our growth plans and enhance our strategic flexibility.”

Piedmont Lithium Board Unanimously Recommend the Transaction

The Merger Agreement and the Transaction have been unanimously approved by the board of directors of Piedmont (“Piedmont Board of Directors”). The Piedmont Board of Directors unanimously recommend shareholders vote in favor of the Transaction and intend to vote, or procure the voting of, any Piedmont shares held by them in favor of the Transaction, in each case subject to a superior proposal.

Strategic Rationale for the Merger

A combination between Piedmont and Sayona will create a simpler and stronger lithium business that is well-positioned to grow through cycles. The combination delivers scale, optimization and growth potential by creating the largest producer of hard rock lithium in North America.

- Creates largest hard rock lithium producer in North America with compelling growth profile

- Currently the largest producing hard rock lithium miner in North America

- Significant combined lithium Ore Reserve estimate totaling 70.4Mt @ 1.15% Li2O and Mineral Resource estimate totaling 153.5Mt @ 1.15% Li2O (Measured and Indicated) and 51.4Mt @ 1.07% Li2O (Inferred)[1]

- Three high-quality development projects and the potential for brownfield expansion of NAL

- Economic alignment to pursue NAL brownfield expansion

- Consolidated NAL offtake economics

- Early, internal studies commenced, underpinned by a significant resource base

- Low capital intensity with a lower cost base and shorter permitting process than identified greenfield projects

- Simplified corporate structure and shared benefits of synergies

- Optimized logistics and procurement with potential to deliver lower operating costs

- Marketing synergies expected through significantly expanded customer relationships

- Strengthened balance sheet with ability to fund and accelerate growth projects

- Capital raising provides MergeCo with funding runway to operate

- MergeCo go forward funding strategy is expected to focus on introducing strategic project-level partners with technical and funding capability and progressing non-dilutive sources of funding

Transaction Structure

The Transaction will be implemented by way of an Agreement and Plan of Merger between Piedmont and Sayona. A newly formed subsidiary of Sayona will merge with Piedmont Lithium which will result in Sayona Mining Limited being the ultimate parent entity of the merged group and will continue to be domiciled in Australia, with an ASX primary listing and a Nasdaq secondary listing of American depository shares (“ADSs”).

Under the terms of the Transaction, existing holders of Piedmont Lithium shares of common stock will receive Sayona ADSs corresponding to 527 Sayona ordinary shares for each Piedmont share of common stock held and existing holders of Piedmont Lithium CHESS Depository Interests (“CDIs”) will receive 5.27 Sayona Mining Limited ASX listed ordinary shares (instead of an ADS) for each Piedmont Lithium CDI held. The Transaction will result in an approximate 50% / 50% equity holding of shareholders of Sayona and Piedmont in MergeCo (on a fully diluted basis), prior to the Conditional Placement.

Governance and Leadership

Upon completion of the Merger, Lucas Dow will become the CEO and Managing Director of MergeCo and Keith Phillips will become a Strategic Advisor to MergeCo for a transition period.

The MergeCo Board will initially consist of 8 members, including (i) 4 directors to be appointed by Piedmont who will be deemed as independent by the Piedmont board, and one of which will be Chair of the MergeCo Board, and (ii) 4 directors to be appointed by Sayona, at least two of which will be deemed as independent by the Sayona board and one of which will be Lucas Dow, CEO of MergeCo.[2]

Independent directors, who are appropriately qualified individuals having regard to MergeCo’s compliance requirements, will serve as the chairpersons of the Audit and Risk Committee, the Nomination Committee and the Remuneration Committee of MergeCo.

MergeCo will have a global presence with corporate headquarters in Brisbane, Australia, and offices in Belmont, North Carolina and Montreal, Quebec. Subject to shareholder approval of the Transaction, MergeCo is intended to be renamed at, or shortly after, the Transaction completion.

Closing Conditions and Timing

The Transaction has been unanimously approved by both the Piedmont and Sayona Boards of Directors. The Transaction is expected to close during the first half of calendar year 2025.

Closing of the Transaction is subject to:

- Approval by Piedmont and Sayona shareholders;

- International regulatory approvals, including approval from the Committee on Foreign Investment in the United States (“CFIUS”), approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“HSR Act”) and approval under the Investment Canada Act;

- Any required ASIC or ASX relief;

- Effectiveness of the proxy statement/prospectus with the U.S. Securities and Exchange Commission; and

- Other customary conditions for a transaction of this nature.

The Merger Agreement includes reciprocal exclusivity arrangements (including notification obligations) in favor of both parties, a matching right regime in favor of both parties and mutual termination fees in favor of both parties. The exclusivity arrangements are subject to customary exceptions that enable the directors of Piedmont and Sayona to comply with their respective fiduciary and/or statutory duties, including in respect of a superior proposal.

Piedmont and Sayona shareholders do not need to take any action at this time. A disclosure document containing important information about the Transaction will be dispatched to Piedmont shareholders and filed with the U.S. Securities and Exchange Commission in due course. A notice of meeting containing important information about the Transaction (“EGM NoM”) will be dispatched to Sayona shareholders and released on ASX in due course, likely in the first half of CY2025.

Further details of the terms and conditions of the Transaction are set out in the Merger Agreement, a copy of which is attached to this announcement.

Equity Raising Overview

As part of the merger, the parties intend to raise equity capital aggregating to approximately US$99 million in a series of transactions.

Piedmont intends to undertake an equity raising of approximately A$40 million (~US$27 million) (the “Piedmont Placement”) (before costs).

The funds from the Piedmont Placement will be applied to fund Piedmont’s standalone expenditures to closing of the Merger, including:

- Progress Ewoyaa and Carolina development, including permit approvals

- Select NAL capital projects to optimize production

- General corporate purposes

In addition to the Transaction, Sayona is separately undertaking a fully underwritten unconditional institutional placement to raise approximately A$40 million (~US$27 million) (the “Sayona Unconditional Placement”) (before costs) through the issue of approximately 1,250.0 million new shares in Sayona (“New Shares”) utilizing Sayona’s available capacity under ASX Listing Rule 7.1.

Further, and conditional on closing of the Merger, MergeCo is undertaking a conditional placement to RCF VIII to raise approximately A$69 million (~US$45 million) (before costs) (the “Conditional Placement”) via the issue of new fully paid ordinary shares in MergeCo. A summary of the terms to the subscription agreement which RCF VIII has entered into can be found in Sayona’s ASX announcement dated 19 November 2024. If the Conditional Placement completes on its terms, then RCF VIII will be entitled to certain information rights and to nominate an observer to the Board. The Conditional Placement will be subject to Sayona shareholder approval for the purposes of the ASX Listing Rules at an extraordinary general meeting (“EGM”), and completion of the proposed Merger in accordance with the terms and conditions of the Merger Agreement among other customary conditions. Full details of the Conditional Placement will be set out in Sayona’s EGM notice of meeting which is expected to be released to the ASX and dispatched to eligible shareholders in the first half of calendar year 2025.

Please refer to Sayona’s ASX announcements for further information.

In addition, and also conditional on closing of the Merger, MergeCo is considering undertaking a further equity raising of up to US$15 million that will enable eligible MergeCo securityholders to participate in an equity financing of MergeCo.

Funds raised through the Conditional Placement will be applied to value accretive spending which will be pursued by MergeCo such as preliminary studies for the NAL brownfield expansion and activities to progress the Ewoyaa, Carolina, and Moblan projects. Further details on the proposed application of funds for the equity raising can be found in the investor presentation lodged on the ASX dated November 19, 2024.

Any securities to be offered in the Piedmont Placement will not be and have not been registered under the Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Timetable

| Events | Date |

| Trading halt and announcement of Merger and Capital Raising | 19 November 2024 |

| Sayona EGM | 1H CY2025 |

| Piedmont shareholder meeting | 1H CY2025 |

| Merger Effective Date | 1H CY2025 |

| Completion of Conditional Placement | 1H CY2025 |

| Anticipated announcement of further equity raising | 1H CY2025 |

The above timetable is indicative only. Piedmont and Sayona reserve the right to amend any or all of these dates at their absolute discretion, subject to the Corporations Act 2001 (Cth), the ASX Listing Rules and any other applicable laws. The quotation of new CDIs is subject to confirmation from the ASX.

Additional Information

Further details of the Transaction and the equity raisings are set out in the Investor Presentation also provided to the ASX today. The Investor Presentation contains important information including key risks and foreign selling restrictions with respect to the equity raisings.

Conference Calls

Piedmont and Sayona management will host joint calls to discuss the Transaction.

The Sayona hosted joint conference call will be held during Australian business hours at 2:30PM AEDT on 19 November 2024. Investors and analysts can access the live webcast at https://webcast.openbriefing.com/ms-mu-2024/

The Piedmont hosted joint conference call will be held during U.S. business hours at 8:30AM ET on 19 November 2024. Investors and analysts can access the live webcast at https://webcast.openbriefing.com/ms-mu-2024/

Advisors and Counsel

J.P. Morgan is acting as exclusive financial advisor and Gibson Dunn, Thomson Geer, and Bennett Jones are acting as legal counsel to Piedmont.

Morgan Stanley is acting as exclusive financial advisor and Herbert Smith Freehills, Baker Botts and McCarthy Tétrault are acting as legal counsel to Sayona.

Canaccord Genuity is acting as equity capital markets advisor to the Transaction.

About Piedmont

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest. Our portfolio of projects includes our wholly owned Carolina Lithium project in the United States and partnerships in Quebec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic Lithium (AIM: ALL; ASX: A11). We believe these geographically diversified operations help us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage. For more information, follow us on Twitter @PiedmontLithium and visit www.piedmontlithium.com.

About Sayona

Sayona Mining Limited is a North American lithium producer (ASX:SYA; OTCQB:SYAXF), with projects in Québec, Canada and Western Australia. In Québec, Sayona’s assets comprise North American Lithium together with the Authier Lithium Project and the Tansim Lithium Project, supported by a strategic partnership with American lithium developer Piedmont Lithium Inc. Sayona also holds a 60% stake in the Moblan Lithium Project in northern Québec. In Western Australia, the company holds a large tenement portfolio in the Pilbara region prospective for gold and lithium. Sayona is exploring for Hemi style gold targets in the world class Pilbara region, while its lithium projects include Company-owned leases and those subject to a joint venture with Morella Corporation. For more information, please visit https://sayonamining.com.au/

About RCF

For more than 25 years, RCF has pioneered private equity investment in critical minerals and mining and forged partnerships with investors, innovators, and miners to mobilize capital into the mining sector. As a global alternative investment firm, we aim to deliver superior returns for all stakeholders. We believe metals and mining are essential for the energy transition, supporting industrialization worldwide and serving as the bedrock for human civilization and advancement, driving growth and innovation in a rapidly evolving landscape. For more information, visit www.resourcecapitalfunds.com

Forward Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “contemplate,” “predict,” “forecast,” “likely,” “believe,” “target,” “will,” “could,” “would,” “should,” “potential,” “may” and similar expressions or their negative, may, but are not necessary to, identify forward-looking statements.

Such forward-looking statements, including those regarding the timing, consummation and anticipated benefits of the transaction described herein, involve risks and uncertainties. The Company’s experience and results may differ materially from the experience and results anticipated in such statements. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but are not limited to, the following factors: the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals of the transaction from the stockholders of the Company or from regulators (including from the Australian court hearing) are not obtained; litigation relating to the transaction; uncertainties as to the timing of the consummation of the transaction and the ability of the Company to consummate the transaction; risks that the proposed transaction disrupts the current plans or operations of the Company; the ability of the Company to retain and hire key personnel; competitive responses to the proposed transaction; unexpected costs, charges or expenses resulting from the transaction; potential adverse reactions or changes to relationships with customers, suppliers, distributors and other business partners resulting from the announcement or completion of the transaction; the Company’s ability to achieve the synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the existing businesses; the impact of overall industry and general economic conditions, including inflation, interest rates and related monetary policy by governments in response to inflation; ability of the Company to commercially extract mineral deposits; risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions); uncertainty about the Company’s ability to obtain required capital to execute its business plan; changes in the market prices of lithium and lithium products; changes in technology or the development of substitute products; geopolitical events, and regulatory, economic and other risks associated therewith, as well as broader macroeconomic conditions. Other factors that might cause such a difference include those discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), which include its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and in the proxy statement to be filed in connection with the proposed transaction. For more information, see the section entitled “Risk Factors” and the forward looking statements disclosure contained in the Company’s Annual Reports on Form 10-K and in other filings. The forward-looking statements included in this communication are made only as of the date hereof and, except as required by the ASX Listing Rules, federal securities laws and rules and regulations of the SEC, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

In connection with the Merger, the Company intends to file with the SEC and mail or otherwise provide to its stockholders a proxy statement regarding the proposed transaction. The Company also plans to file other relevant documents with the SEC regarding the proposed transaction. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and stockholders will be able to obtain free copies of these documents (if and when available), and other documents containing important information about the Company and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s website at www.piedmontlithium.com or by contacting the Company’s Investor Relations Department by email at info@piedmontlithium.com or by phone at +1 (704) 461-8000.

Participants in the Solicitation

The Company and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of the Company is set forth in the Company’s proxy statement for its 2024 annual meeting of stockholders, which was filed with the SEC on April 28, 2023, and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023, as amended on April 25, 2023. You can obtain a free copy of these documents from the Company using the contact information above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the proxy statement carefully when it becomes available before making any voting decisions. You may obtain free copies of these documents from the Company using the contact information indicated above.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. The proposed transaction will be implemented solely pursuant to the terms and conditions of the arrangement agreement, which contain the full terms and conditions of the proposed transaction.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

The information contained herein and previously reported by North American Lithium has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Canadian mining terms defined in accordance with the requirements of NI 43-101. Comparable terms are now also defined by the U.S. Securities and Exchange Commission (“SEC”) in its newly adopted Modernization of Property Disclosures for Mining Registrants as promogulated in its S-K 1300 standards. While the guidelines for reporting mineral resources, including subcategories of measured, indicated, and inferred resources, are largely similar for NI 43-101 and S-K 1300 standards, information contained herein that describes North American Lithium’s mineral deposits is not fully comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. Piedmont does not guaranty or verify the accuracy of any of the historical reporting of North American Lithium.

Annexure 1

Piedmont and Sayona Mineral Resources

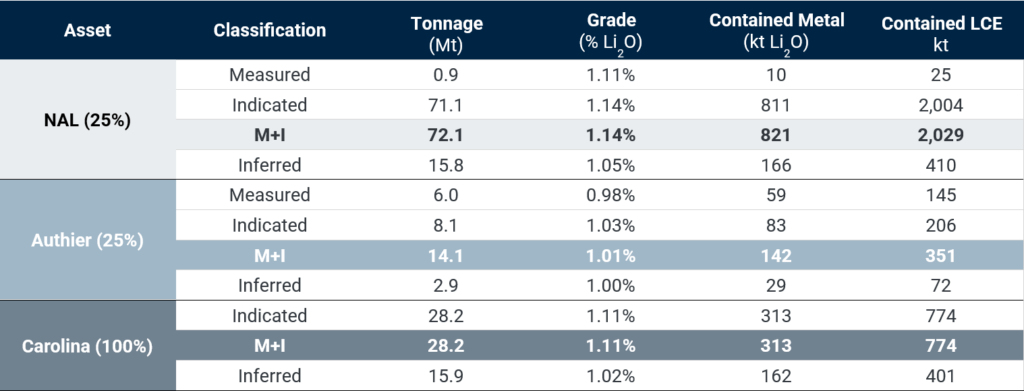

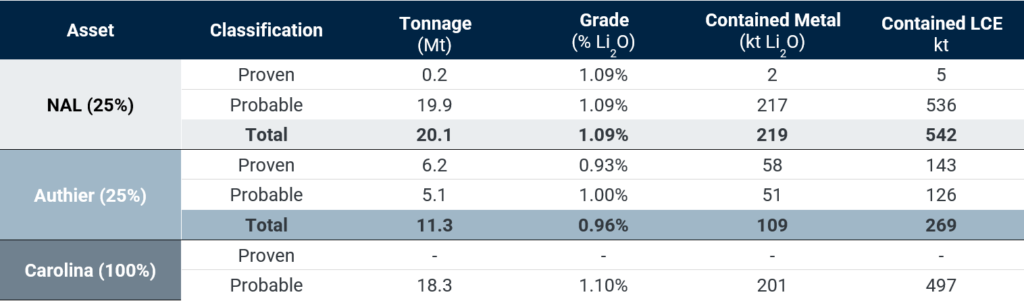

Mineral Resources (100% basis) – Piedmont

Piedmont’s current Ore Reserves and Mineral Resource Estimates (reported by Piedmont or its joint venture partners in accordance with the JORC Code (2012 edition)) are set out below (reported on a 100% basis).

The information in this announcement that relates to the ore reserves and mineral resource estimates of Piedmont’s Carolina Lithium project has been extracted from the ASX announcement “Piedmont Completes BFS of the Carolina Lithium Project” released on 15 December 2021 which is available at www.asx.com.au.

Piedmont confirms that it is not aware of any new information or data that materially affects the information included in that market announcement and that all material assumptions and technical parameters underpinning the estimates in that market announcement continue to apply and have not materially changed. Piedmont confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from that market announcement.

Mineral Resources

Ore Reserves

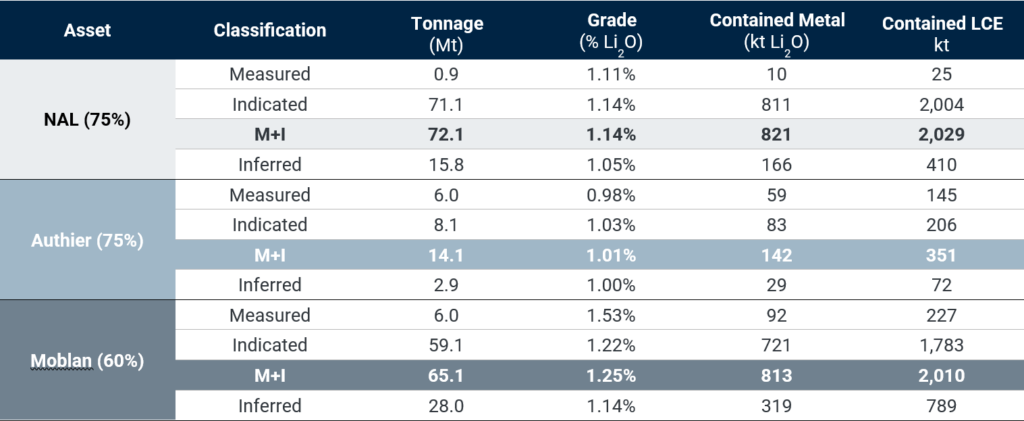

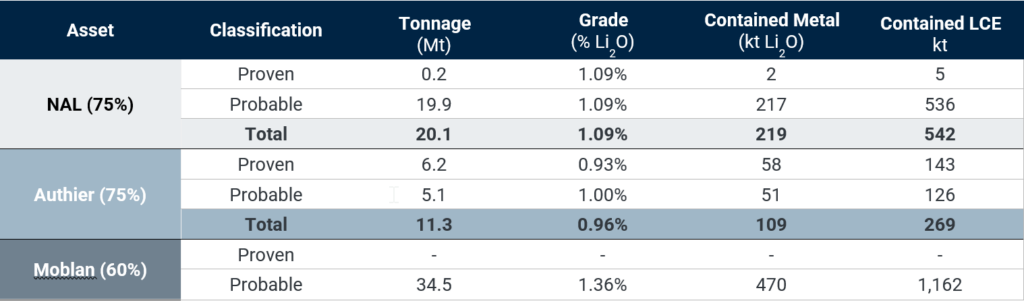

Mineral Resources (100% basis) – Sayona

Sayona’s current Ore Reserve Estimates and Mineral Resource Estimates (reported by Sayona in accordance with the JORC Code (2012 edition)) are set out below (reported on a 100% basis).

The information in this announcement that relates to the ore reserves and mineral resource estimates of Sayona’s projects (i.e. NAL, Authier and Moblan) has been extracted from the ASX announcement titled “Annual Report to Shareholders” released on 27 August 2024 and which is available at www.asx.com.au.

Sayona confirms that it is not aware of any new information or data that materially affects the information included in that market announcement and that all material assumptions and technical parameters underpinning the estimates in that market announcement continue to apply and have not materially changed. Sayona confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from that market announcement.

Mineral Resources

Ore Reserves

1. Combined Piedmont and Sayona spodumene Ore Reserves and Mineral Resource Estimates (in the measured and indicated category, inclusive of Ore Reserves). Ore Reserves and Mineral Resource Estimates reported in accordance with the JORC code. Metrics as reported and shown on a net attributable basis, refer to supporting information in Annexure 1.

2. Sayona Mining shareholders will be asked to vote on a resolution removing the casting vote of the Sayona Chair at the upcoming Sayona Annual General Meeting to be held on Thursday, November 28, 2024. However, upon closing of the Transaction, if the Sayona constitution continues to provide the Chair of the Sayona board with a casting vote on resolutions before the Sayona board of directors, Piedmont has confirmed that such casting vote shall not, at any point in time, be exercised.

For further information, contact:

Sayona Mining

Andrew Barber

Director of Investor Relations

T: +617 3369 7058

E: ir@sayonamining.com.au