NEW YORK –

Piedmont Lithium Limited (ASX:PLL; NASDAQ:PLL) (“Piedmont” or

“Company”) announced today that it will participate in an investor

webinar and Q&A session on Wednesday, May 29, 2019, at 1:00 p.m. EDT

hosted by RedChip Companies.

The webinar will feature a presentation by Keith Phillips, President and

CEO, who will discuss recent developments and upcoming milestones at the

Company’s world-class lithium project in North Carolina. Please note

that this webinar was pre-recorded using a prior company presentation.

To view the webinar, please visit: https://www.redchip.com/events/41/piedmont-lithium-webinar

About Piedmont Lithium

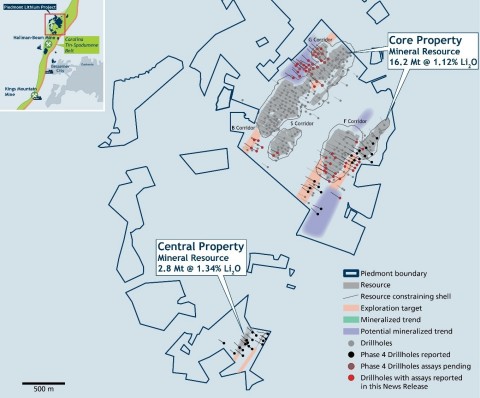

Piedmont Lithium Limited (ASX:PLL; Nasdaq:PLL) holds a 100% interest in

the Piedmont Lithium Project located within the Carolina Tin-Spodumene

Belt (“TSB”) and along trend to the Hallman Beam and Kings Mountain

mines, which historically provided most of the western world’s lithium

between the 1950s and the 1980s. The TSB has been described as one of

the largest lithium regions in the world and is located approximately 25

miles west of Charlotte, North Carolina.

In September 2018 the Company published a Scoping Study for an

integrated lithium hydroxide business based on a maiden Mineral Resource

estimate of 16.2 million tonnes (“Mt”) grading at 1.12% Li2O which

featured a 13-year project life, NPV8 of US$888 million, a US$3,112 per

tonne lithium hydroxide operating cost, and a US$193 per tonne spodumene

concentrate operating cost.

Forward Looking Statements

This announcement may include forward-looking statements. These

forward-looking statements are based on Piedmont’s expectations and

beliefs concerning future events. Forward looking statements are

necessarily subject to risks, uncertainties and other factors, many of

which are outside the control of Piedmont, which could cause actual

results to differ materially from such statements. Piedmont makes no

undertaking to subsequently update or revise the forward-looking

statements made in this announcement, to reflect the circumstances or

events after the date of that announcement.

Cautionary Note to United States Investors Concerning Estimates of

Measured, Indicated and Inferred Resources

The information contained in this announcement has been prepared in

accordance with the requirements of the securities laws in effect in

Australia, which differ from the requirements of U.S. securities laws.

The terms “mineral resource”, “measured mineral resource”, “indicated

mineral resource” and “inferred mineral resource” are Australian terms

defined in accordance with the 2012 Edition of the Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore Reserves

(the “JORC Code”). However, these terms are not defined in Industry

Guide 7 (“SEC Industry Guide 7”) under the U.S. Securities Act of 1933,

as amended (the “U.S. Securities Act”), and are normally not permitted

to be used in reports and filings with the U.S. Securities and Exchange

Commission (“SEC”). Accordingly, information contained herein that

describes Piedmont’s mineral deposits may not be comparable to similar

information made public by U.S. companies subject to reporting and

disclosure requirements under the U.S. federal securities laws and the

rules and regulations thereunder. U.S. investors are urged to consider

closely the disclosure in Piedmont’s Form 20-F, a copy of which may be

obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.

Competent Persons Statement

The information in this announcement that relates to Exploration Results

is based on, and fairly represents, information compiled or reviewed by

Mr. Lamont Leatherman, a Competent Person who is a Registered Member of

the ‘Society for Mining, Metallurgy and Exploration’, a ‘Recognized

Professional Organization’ (RPO). Mr. Leatherman is a consultant to the

Company. Mr. Leatherman has sufficient experience that is relevant to

the style of mineralization and type of deposit under consideration and

to the activity being undertaken to qualify as a Competent Person as

defined in the 2012 Edition of the ‘Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves’. Mr. Leatherman

consents to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

The Project’s Mineral Resource of 16.2Mt @ 1.12% Li2O comprises

Indicated Mineral Resources of 8.5Mt @ 1.15% Li2O and Inferred Mineral

Resources of 7.7Mt @ 1.09% Li2O. The information in this announcement

that relates to Exploration Targets and Mineral Resources is extracted

from the Company’s ASX announcement dated June 14, 2018 which is

available to view on the Company’s website at www.piedmontlithium.com.

The information in this announcement that relates to Metallurgical

Testwork Results is extracted from the Company’s ASX announcements dated

September 4, 2018 and July 17, 2018 which are available to view on the

Company’s website at www.piedmontlithium.com.

The information in this announcement that relates to Process Design,

Process Plant Capital Costs, and Process Plant Operating Costs is

extracted from the Company’s ASX announcements dated September 13, 2018

and July 19, 2018 which are available to view on the Company’s website

at www.piedmontlithium.com.

The information in this announcement that relates to Mining Engineering

and Mine Schedule is extracted from the Company’s ASX announcements

dated September 13, 2018 and July 19, 2018 which are available to view

on the Company’s website at www.piedmontlithium.com.

Piedmont confirms that: a) it is not aware of any new information or

data that materially affects the information included in the original

ASX announcements; b) all material assumptions and technical parameters

underpinning Mineral Resources, Exploration Targets, Production Targets,

and related forecast financial information derived from Production

Targets included in the original ASX announcements continue to apply and

have not materially changed; and c) the form and context in which the

relevant Competent Persons’ findings are presented in this report have

not been materially modified from the original ASX announcements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190528005700/en/

Keith D. Phillips

President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Anastasios (Taso) Arima

Executive Director

T: +1 347 899 1522

E: tarima@piedmontlithium.com

Bruce Haase

RedChip Companies

407-644-4256, ext. 131

bruce@redchip.com