NEW YORK, Jan. 29, 2019 (GLOBE NEWSWIRE) — Piedmont Lithium Limited (ASX: PLL; NASDAQ: PLL) (“Piedmont” or “Company”) is pleased to present its December 2018 quarterly report.

Highlights during and subsequent to the quarter were:

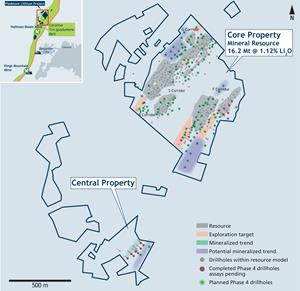

- Commenced a new 25,000-meter Phase 4 drill program at the Piedmont Lithium Project (“Project”), with 19,000 meters allocated for infill and exploration drilling on the Core property and 6,000 meters allocated for exploration drilling on the Central and Sunnyside properties;

- Increased land position of the Project by 15% to 1,383 acres, including 93 acres which are contiguous to the Core property increasing it by 18% to a total of 622 acres. Drill targets from the new properties have been incorporated into the current drilling program;

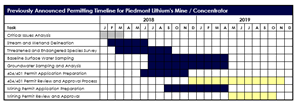

- Submitted key permit applications for the Project, including a Section 404 Standard Individual Permit application to the US Army Corps of Engineers (USACE) and a Section 401 Individual Water Quality Certification to the North Carolina Division of Water Resources (NCDWR);

- Completed initial exploratory drilling on the Company’s new Sunnyside and Central properties in the Carolina Tin-Spodumene Belt (“TSB”), which returned encouraging results, including the Project’s widest intercept to-date; and

- Completed the first tranche of a private placement of 111 million shares at an issue price of A$0.11 per share to raise gross proceeds of A$12.2 million. Proceeds will be used for drilling to expand and upgrade the resource base at the Project, as well as for permit applications, metallurgical testwork, additional engineering studies, and ongoing land consolidation.

Next steps:

- Piedmont will complete the Phase 4 drill program and seek to extend Project life through an increase in the Project’s Mineral Resource;

- Further metallurgical studies, including evaluating the potential for a Dense Medium Separation (“DMS”) before the flotation circuit, to further enhance operating costs in the concentrator;

- Complete permit applications and secure the necessary permits and approvals to commence mining and processing operations at the Project; and

- Continue expansion of the Company’s land position in the Carolina Tin-Spodumene Belt (“TSB”) with a focus on areas of high mineral prospectivity.

The entire report is available on the announcement page of the Company’s website at https://ir.piedmontlithium.com/asx-announcements.

For further information, contact:

Keith D. Phillips

President & CEO

T: +1 973 809 0505

E: keith@piedmontlithium.com

Anastasios (Taso) Arima

Executive Director

T: +1 347 899 1522

E: taso@piedmontlithium.com

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on the Company’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the Company, which could cause actual results to differ materially from such statements. The Company makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information contained in this presentation has been prepared in accordance with the requirements of the securities laws in effect in Australia, which differ from the requirements of U.S. securities laws. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are Australian terms defined in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the “JORC Code”). However, these terms are not defined in Industry Guide 7 (“SEC Industry Guide 7”) under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and are normally not permitted to be used in reports and filings with the U.S. Securities and Exchange Commission (“SEC”). Accordingly, information contained herein that describes Piedmont’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. U.S. investors are urged to consider closely the disclosure in Piedmont’s Form 20-F, a copy of which may be obtained from Piedmont or from the EDGAR system on the SEC’s website at http://www.sec.gov/.

Competent Persons Statements

The information in this presentation that relates to Exploration Results is extracted from the Company’s ASX announcements dated August 23, 2018, July 19, 2018, June 14, 2018, June 7, 2018, May 17, 2018, May 10, 2018, April 9, 2018, 4 April 2018, 15 March 2018, 1 December 2017, 2 November 2017, 27 September 2017, 23 May 2017, 3 April 2017, and 18 October 2016 which are available to view on the Company’s website at www.piedmontlithium.com.

The information in this presentation that relates to Exploration Targets and Mineral Resources is extracted from the Company’s ASX announcement dated June 14, 2018 which is available to view on the Company’s website at www.piedmontlithium.com.

The information in this presentation that relates to Metallurgical Testwork Results is extracted from the Company’s ASX announcements dated September 4, 2018 and July 17, 2018 which are available to view on the Company’s website at www.piedmontlithium.com.

The information in this presentation that relates to Process Design, Process Plant Capital Costs, and Process Plant Operating Costs is extracted from the Company’s ASX announcements dated September 13, 2018 and July 19, 2018 which are available to view on the Company’s website at www.piedmontlithium.com.

The information in this presentation that relates to Mining Engineering and Mine Schedule is extracted from the Company’s ASX announcements dated September 13, 2018 and July 19, 2018 which are available to view on the Company’s website at www.piedmontlithium.com.

Piedmont confirms that: a) it is not aware of any new information or data that materially affects the information included in the original ASX announcements; b) all material assumptions and technical parameters underpinning Mineral Resources, Exploration Targets, Production Targets, and related forecast financial information derived from Production Targets included in the original ASX announcements continue to apply and have not materially changed; and c) the form and context in which the relevant Competent Persons’ findings are presented in this report have not been materially modified from the original ASX announcements.