NEW YORK, March 18, 2018 /PRNewswire/ — Piedmont Lithium Limited (ASX: PLL; OTC – Nasdaq International: PLLLY)(“Piedmont” or “Company”) is pleased to announce that it has filed a registration statement on Form 20-F to register its ordinary shares with the United States Securities and Exchange Commission (“SEC”). The registration statement remains subject to review by the SEC staff. A Form 20-F, once declared effective by the SEC, allows certain non-U.S. issuers to register securities with the SEC pursuant to applicable U.S. securities laws.

Piedmont’s registration of ordinary shares, if approved, would allow American depositary shares (“ADSs”) representing ordinary shares to be listed on a national securities exchange in the United States. The Company has made an application to list the ADSs on the Nasdaq Capital Market (“Nasdaq”), with each ADS representing 100 ordinary shares of the Company.

The Company will maintain its existing listing of ordinary shares on the Australian Securities Exchange (“ASX”) under the symbol “PLL”. A copy of the Form 20-F registration statement filed with the SEC is available on Piedmont’s website.

In addition, the Company is pleased to announce the appointment of Mr. Jorge M. Beristain to the Board of Directors as an Independent Non-Executive Director. Mr. Robert Behets has advised that he will step down from his Non-Executive Director position.

Mr. Beristain recently retired as Managing Director and Head of Deutsche Bank’s Americas Metals & Mining equity research, where he was consistently ranked by institutional investors as one of the top analysts in the United States. During his over 20-year career on Wall Street, Mr. Beristain has lived and worked in the United States, Latin America and Canada and has visited hundreds of industrial companies worldwide. He is a proven strategic thinker with extensive international experience in the valuation of mining projects and metals operations and downstream metal uses. Mr. Beristain holds a Bachelor of Commerce degree from the University of Alberta and is a Chartered Financial Analyst.

The appointment of Mr. Beristain and the resignation of Mr. Behets will be effective from the date that the ADSs are listed in the United States. As a result of being appointed as a Director, Mr. Beristain will receive 1,000,000 incentive options (500,000 exercisable at A$0.25 on or before 30 June 2020 and 500,000 exercisable at A$0.35 on or before 31 December 2020).

Keith D. Phillips, President and Chief Executive Officer, said, “Our proposed U.S. listing is an important milestone for Piedmont Lithium and is expected to create greater exposure among institutional and retail investors in the U.S. and internationally. We are also pleased to welcome Jorge to the Board and are confident that we will gain from his independent perspective and deep relationships within the institutional investor community. And on behalf of the Board, I would like to thank Robert for his valuable contributions to the Company.”

This press release is neither an offer to sell nor a solicitation of an offer to buy any securities.

About Piedmont Lithium

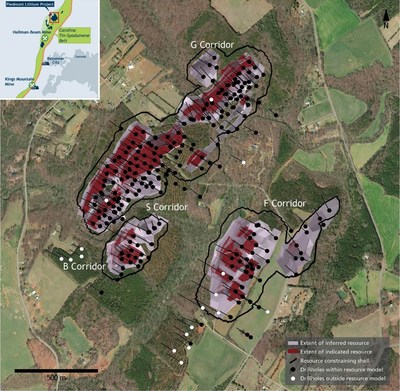

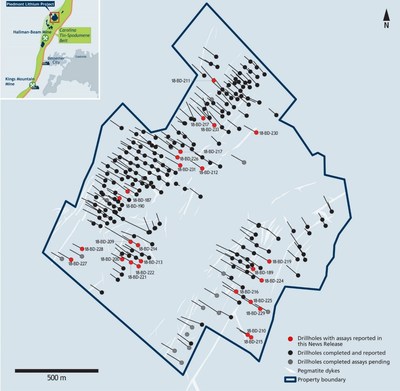

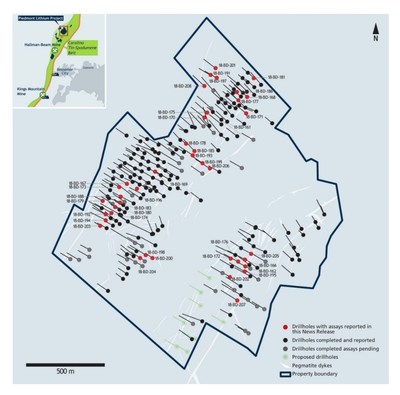

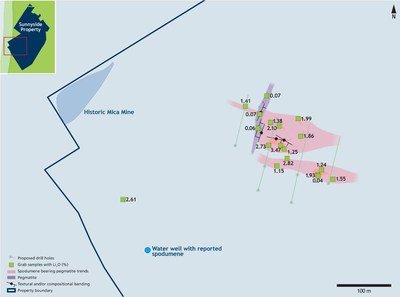

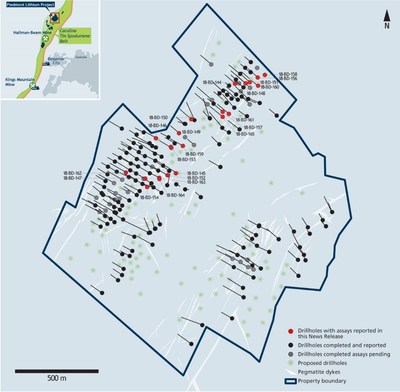

Piedmont Lithium Limited (ASX: PLL; OTC-Nasdaq Intl: PLLLY) holds a 100% interest in the Piedmont Lithium Project (“Project”) located within the world-class Carolina Tin-Spodumene Belt (“TSB”) and along trend to the Hallman Beam and Kings Mountain mines, historically providing most of the western world’s lithium between the 1950s and the 1990s. The TSB has been described as one of the largest lithium provinces in the world and is located approximately 25 miles west of Charlotte, North Carolina. It is a premier location to be developing and integrated lithium business based on its favourable geology, proven metallurgy and easy access to infrastructure, power, R&D centres for lithium and battery storage, major high-tech population centres and downstream lithium processing facilities.

The Project was originally explored by Lithium Corporation of America which eventually was acquired by FMC Corporation (“FMC”). FMC and Albemarle Corporation (“Albemarle”) both historically mined the lithium bearing spodumene pegmatites within the TSB and developed and continue to operate the two world-class lithium processing facilities in the region which were the first modern spodumene processing facilities in the western world. The Company is in a unique position to leverage its position as a first mover in restarting exploration in this historic lithium producing region with the aim of developing a strategic, U.S. domestic source of lithium to supply the increasing electric vehicle and battery storage markets.

Piedmont, through its 100% owned U.S. subsidiary, Piedmont Lithium Inc., has entered into exclusive option agreements and land acquisition agreements with local landowners, which upon exercise, allow the Company to purchase (or in some cases long-term lease) approximately 1,200 acres of surface property and the associated mineral rights.

Forward Looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on Piedmont’s expectations and beliefs concerning future events. Forward looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Piedmont, which could cause actual results to differ materially from such statements. Piedmont makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of that announcement.

Competent Persons Statement

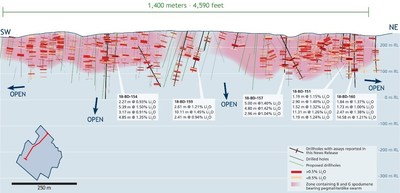

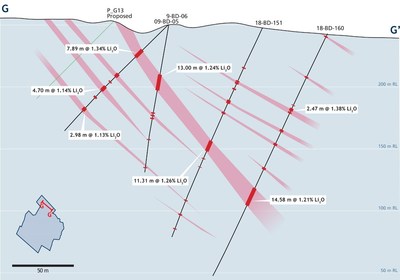

The information in this announcement that relates to Exploration Results is based on, and fairly represents, information compiled or reviewed by Mr. Lamont Leatherman, a Competent Person who is a Registered Member of the ‘Society for Mining, Metallurgy and Exploration’, a ‘Recognized Professional Organization’ (RPO). Mr. Leatherman is a consultant to the Company. Mr. Leatherman has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Leatherman consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

View original content:http://www.prnewswire.com/news-releases/piedmont-lithium-files-registration-statement-for-proposed-us-listing-and-adds-us-based-independent-director-300615687.html

View original content:http://www.prnewswire.com/news-releases/piedmont-lithium-files-registration-statement-for-proposed-us-listing-and-adds-us-based-independent-director-300615687.html

SOURCE Piedmont Lithium Limited

![]() View original content:http://www.prnewswire.com/news-releases/piedmont-lithium-investor-webinar-300666862.html

View original content:http://www.prnewswire.com/news-releases/piedmont-lithium-investor-webinar-300666862.html